- On Tuesday, Paypal's share price rose by more than 13 per cent in extended trading after the firm announced its financial results.

On Tuesday, Paypal’s share price rose by more than 13 per cent in extended trading after the firm announced its financial results that showed stronger than expected growth. This resulted in an up gap of 13 per cent in yesterday’s trading session. However, Wednesday’s trading session moved aggressively bearish throughout the day, which saw the company close the market down by 3.5 per cent from its opening price. Due to the up gap, the actual

The company surge on Tuesday was also partly due to its announcement that it had entered an information-sharing partnership with Elliot Management. According to reports, the partnership would involve discussing the company’s value creation.

For context, Elliot Management, one of the biggest asset managers in the world, is also among the top investors in Paypal, with approximately $2 billion of investment in the company. As a result, Elliot is also well positioned to contribute to PayPay’s value propositions. According to Elliott managing partner Jesse Cohn, they view PayPal as a company with an unmatched and industry-leading footprint across its payment business, an advantage they can use in both the short-term and long term.

According to financial results released on Tuesday, Paypal paid 93 cents per share adjusted vs 86 cents per share which many experts expected. The company also recorded a revenue of $6.81 billion, which was also an improvement from the projected $6.79 by analysts. The overperformance of the company saw the shares surging.

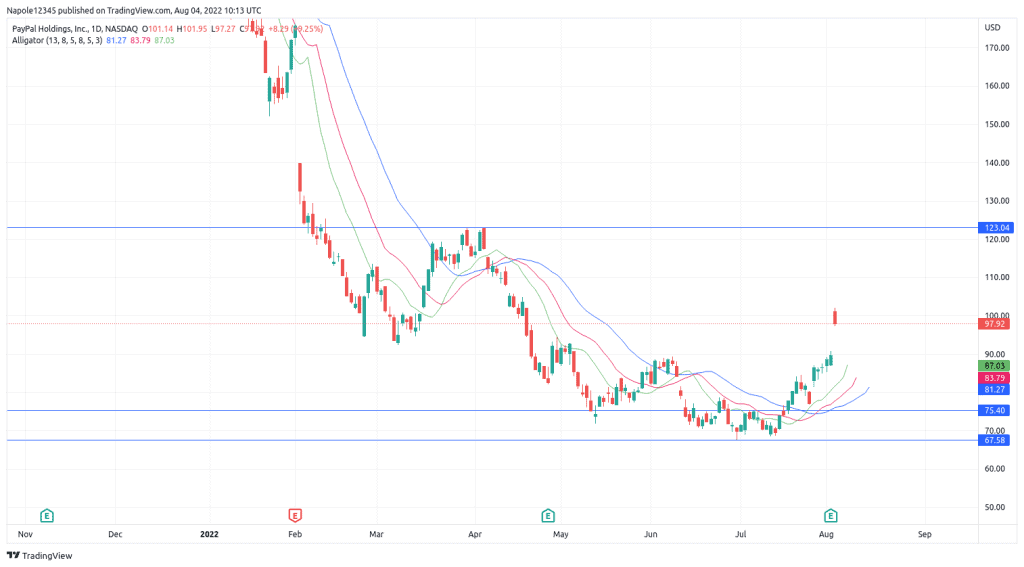

PayPal Share Price Analysis

Yesterday’s drop of 4 per cent, despite the trading session closing 9 per cent up from the previous close due to an up gap, indicated we may still be able to see a further push to the downside. However, Before the financial report was released, PayPal was on a five trading session bullish streak and had entered a long-term bullish trend.

Therefore, my PayPal share price analysis indicates Paypal’s long-term trend will continue despite yesterday’s price fall. I expect the prices to rise and trade above $100. There is a high likelihood that we may see the prices returning to trade above the 120 price level, a price level Paypal has not traded since April.

However, should the prices fall below this week’s price low of $85, then my analysis will be invalidated. It will also mean a possible bear move for the share price.

PayPal Daily Chart