- The Ocado share price is struggling even as the UK retail sales rise. The OCDO stock is trading at 1,697p. What next?

The Ocado share price is struggling even as the UK retail sales rise. The OCDO stock is trading at 1,697p, which is about 41% below the highest level this year. Other retailers like Marks and Spencer, Morrisons, and Tesco have done relatively well.

The UK retail sector is doing relatively well amid the Omicron outbreak. Data published by the Office of National Statistics (ONS) showed that the headline retail sales rose by 4.7% in November as Christmas shopping intensified. This increase was better than the median estimate of 4.2%. Additional data showed that the core retail sales rose by 2.7% in November after falling by 1.9% in the previous month.

The Ocado share price has struggled because the recent directives by the government have not been strict enough. This means that people are still visiting stores as they did before the Omicron variant emerged.

The stock is also struggling as investors react to the recent patent victory. A judge at the International Trade Commission said that the company did not infringe on Autostore patents.

Ocado share price forecast

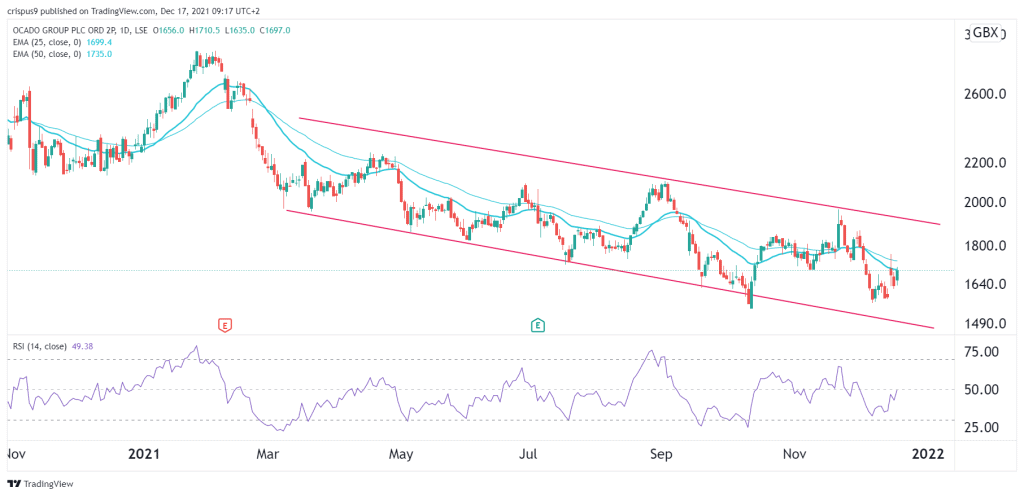

The daily chart shows that the Ocado share price has been in a strong bearish trend in the past few months. It has dropped by more than 40% from the YTD high. It has also formed a descending channel that is shown in red. Also, the stock is trading at the 25-day and 50-day moving averages while the Relative Strength Index (RSI) is at a neutral level.

Therefore, the pair will likely keep falling as bears target the lower side of the descending channel at about 1,500p. On the flip side, a move above the key resistance at 1,800p will invalidate this view.