- The Ocado share price is on the verge of a steep selloff despite a new partnership deal struck with Groupe Casino.

The Ocado share price is down 1.67% on Monday as investor scepticism trails the recent joint venture partnership between Ocado Group PLC and French retailer Groupe Casino. The partnership will see both companies setting up customer fulfilment centres throughout France.

A new Ocado Smart Platform (OSP) will also be launched, allowing global partners to list their products on the platform. The new fulfilment centres will feature the new robot-operated online delivery system that Ocado has invested massively in during the past year.

The Ocado share price has seen its stock fall by 18% in June and nearly 50% since the start of 2022. Despite raising nearly 580 million pounds via a rights issue and an additional bank loan of 300 million pounds to finance its expansion program, the Ocado share price was downgraded by Credit Suisse due to a lack of sufficient new customers sign-ups.

The recent fundraising also received scepticism from analysts at Shore Capital and AJ Bell. Ocado Retail, owned 50% by the Ocado Group, also issued an earlier profit warning that sparked a new round of selling in the stock.

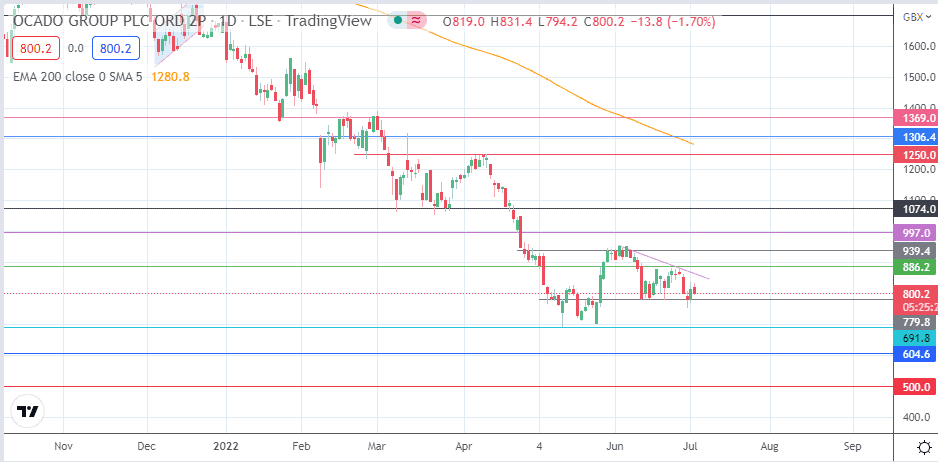

A look at the Ocado share price daily chart indicates that the momentum lies with the bears due to the progressively lower highs of 8 June and 29 June. This scenario indicates a potential stall in the retracement rally.

Ocado Share Price Outlook

The intraday decline puts the Ocado share price on a collision course with the 779.8 support level (9 May and 16 June lows). A breakdown of this pivot allows the bears access to the 691.8 support mark, formed by the 12 May 2022 candle’s low. Additional pivots are found at 604.6 (12 March 2018 high) and the 500.0 psychological price level formed by the previous lows of 13 April 2018/27 April 2018. Attainment of the 604.6 support level covers the upside gap of 17 May 2018.

The flip side of the coin sees a further recovery in the stock if the bulls somehow force a break of the 939.4 resistance (1 June high). This break could allow for a push toward 997.0 before 1074.0 (17 March low and 22 April high) emerges as a new northbound target. Above this level, 1250.0 is a psychological target that is formed by a prior high on 8 April 2022.

Ocado: Daily Chart