- While the news of the recent QE was bearish for the dollar, NZDUSD is trading higher on news of the RBNZ’s asset purchase program.

While the news of the recent QE was bearish for the dollar, the Kiwi seemed to benefit from news of the RBNZ’s asset purchase program. NZDUSD is trading higher today after the central bank proposed to buy 250 million-worth of government bonds. As of this writing, the currency pair is 0.79% or 46 pips higher from its opening price.

According to the central bank, the adverse effects of the coronavirus has caused a heavier strain on the economy. The number of cases in New Zealand has risen by 47 in 24 hours and the government has imposed a lockdown. This means that all non-essential businesses will be closed, similar to restrictions imposed by other countries.

It also helps NZDUSD that risk appetite is up in today’s Asian session as market participants await the US Senate’s vote on more fiscal stimulus.

Lastly, trade balance numbers released overnight managed to top expectations. According to Statistics New Zealand, the value of exports outpaced imports by 594 million NZD in February. A more modest trade surplus of 550 million NZD was only expected by analysts.

Read our Best Trading Ideas for 2020.

NZDUSD Outlook

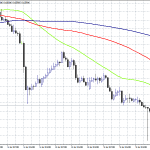

On the daily time frame, we can see that NZDUSD has ample room to trade higher and still maintain its downtrend. By connecting the highs of December 31, January 16, January 24, and March 9, we can see that trend line resistance is around the 0.6200 handle. This price also seems to coincide with the currency pair’s previous lows. This means that if there are enough buyers in the market, NZDUSD may still go as high as 360 pips before it encounters its first major resistance level.

However, a closer look at the 4-hour time frame suggests that there may not be enough buyers in the market. The currency pair has recently been consolidating after a drastic drop. Consequently, this has allowed for a bearish pennant pattern to form. Considered as a bearish continuation pattern, a close below yesterday’s low at 0.5665 could mean a sell-off to last week’s lows at 0.5467.