- NZDUSD trades 0.23% lower at 0.6278 as the optimism around trade talks between the two biggest economies fades away. New Zealand CPI came in better

NZDUSD trades 0.23% lower at 0.6278 as the optimism around trade talks between the two biggest economies fades away. New Zealand CPI came in better than expected, the Consumer Price Index (quarter over quarter) registered at 0.7% beating expectations of 0.6% in 3Q, the yearly CPI reading came in at 1.5% above expectations of 1.4%. Last week, New Zealand’s manufacturing PMI in September came in unchanged in August at 48.4. NZDUSD felt pressure after RBA cut interest rates and investors increase bets that RBNZ will follow. RBNZ, in its last monetary policy committee, left interest rates unchanged at 1% as expected by markets. The central bank noted that the risks are to the downside amid trade tensions, geopolitical turbulence and low business confidence.

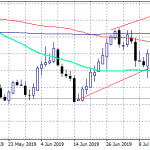

NZDUSD Support and Resistance

NZDUSD corrects after it stalled last Friday at 0.6353 the 50-day moving average and today sellers are taking advantage cancelling the recent positive momentum. On the downside, immediate support stands at 0.6268 daily low and then at 0.6254 the low from October 3rd, a convincing break below might force the pair down to 0.6169 the lows from June 2009. On the upside, immediate resistance stands 0.6334 today’s high, the next target is the 50-day moving average at 0.6349. NZDUSD short term outlook is bearish and a visit down to 2015 lows can’t be ruled out.