- On technical side, the NZDUSD bearish momentum is intact, as it trades below all major daily and hourly moving averages. Now the pair’s immediate support

NZDUSD is trading 0.34% higher at 0.6385 rebounding from 44 month lows after New Zealand’s Q2 Retail Sales came in at 0.2% growth versus 0.7% prior while Retail sales ex-Autos grew only 0.3% against 0.6% earlier. RBNZ Governor Adrian Orr sain in an interview that the 50 bps interest rate cut reduces the probabability of having to do more later. Reserve Bank of New Zealand cut aggressively the OCR by 50bp to 1.00%, while the market forecasting a 25bp cut. The RBNZ Monetary Policy Committee expects growth to remain soft in the near term. The central bank has revised its GDP forecasts lower accordingly by -0.3 to -0.5 through the second quarter of next year.

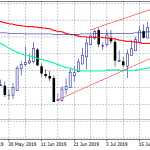

On technical side, the NZDUSD bearish momentum is intact, as it trades below all major daily and hourly moving averages. Now the pair’s immediate support stands at 0.6360 today’s low which if breached the pair will head to 0.6346 the low from January 2016. On the upside immediate resistance stands at 0,6407 yesterday’s high and then at 0.6437 the 200 hour moving average. The RSI index is hovering in oversold area, so we can’t rule out a rebound above 0.64. NZDUSD technical picture is bearish and, a visit down to 2016 lows looks possible.