- The NZDUSD price has retreated as traders start pricing that Trump will win the 2020 election. The pair ignored positive New Zealand jobs data

The NZD to USD (NZDUSD) pair is down sharply today as traders focus on the US election, ignoring the better-than-expected jobs numbers from New Zealand. The pair is trading at 0.6652, which is 1.9% lower than the intraday high of 0.6743.

In a report earlier today, the New Zealand statistics bureau said that the country’s unemployment rate rose to 5.3% in the third quarter from 4.0% in Q2. That 1.3% increase was the biggest gain since the bureau started collecting the data. It attributed this increase to the coronavirus pandemic that has decimated most of the services industry, particularly hotels and restaurants.

The participation rate increased to 70.1% from the previous 69.7%. That was better than the consensus estimates of 70.0%. Also, the labour cost index, which looks at the salaries paid by workers rose by 0.4% quarter-on-quarter (QoQ) and by 1.6% year-on-year. The two were also better than what analysts were expecting.

To be fair, the weakness of the NZDUSD is because of the overall performance of the US dollar. The dollar index is up by more than 0.70% as traders wait for the final tally. As of this writing, Joe Biden is significantly ahead of Donald Trump. But the race is still close in key battleground states like Pennsylvania and Texas. Still, traders in the betting market have already started predicting a Trump win, as shown below.

Similarly, the dollar’s rise is probably a sign that traders also believe that Trump will win a second term. That is because, as I wrote yesterday, analysts were recommending shorting the dollar if Biden wins.

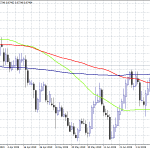

NZDUSD technical outlook

The hourly chart below shows that the NZDUSD has been relatively volatile today. The pair has dropped from a high of 0.6743 to a low of 0.6615 and is currently trading at 0.6652. This high volatility is evidenced by the Average True Range (ATR), which has risen to the highest level in months. The price is also slightly above the 28-day and 14-day exponential moving averages.

Therefore, for today, the outlook for the kiwi is neutral since I expect significant volatility. As such, the key support and resistance levels to watch are the day’s low of 0.6615 and the high of 0.6743.