- NZDUSD continues to take advantage of USD weakness for the fourth day in a row and trades 0.11% higher at 0.6735 making fresh five-month highs

NZDUSD continues to take advantage of USD weakness for the fourth day in a row and trades 0.11% higher at 0.6735 making fresh five-month highs. The Kiwi supported by stronger manufacturing PMI from China released earlier today. The China NBS Manufacturing PMI came in at 50.2, topping analysts expectations of 50.1 in December. The PMI holds for the second month above the 50 mark which signals the expansion territory. The China Non-Manufacturing PMI registered at 53.5 below market consensus of 53.6.

Read our Best Trading Ideas for 2020.

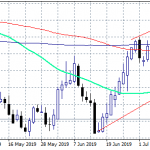

NZDUSD: RSI A Warning Signal for Bulls

The technical outlook is bullish for NZDUSD and traders are targeting higher levels. The initial resistance level for the pair stands at 0.6737 the daily top. If the pair manages to break above more offers might await at 0.6786 the high from July 21st. The next supply zone would be met at 0.6923 the high from March 24th.

On the downside, first support will be met at 0.6703 the daily low. In case that the pair breaks below, the next support zone stands at 0.6624 the December 26th low. The December rally might be cancelled only if NZDUSD breaches the 200-day moving average at 0.6522.

The RSI 14 indicator flashes a warning signal as it hovers at 79.51 a reading that we haven’t seen on 2019.