- The Nio share price posted gains this Monday after the company obtained preliminary approval to list its shares on the Hong Kong index.

The Nio share price has edged up 3.87% this Monday as of writing after it emerged that the company had obtained preliminary approval to list on the Hong Kong stock exchange. The news appeared to have pleased investors and driven some demand to the stock, which has endured some relentless selling in recent sessions. The Chinese EV maker announced on Sunday that it had been granted preliminary approval on its application to list its Class A ordinary shares on the Hang Seng index.

This approval opens the door for the stock to start trading on 10 March, subject to a final approval process. While the stock will remain listed on the New York Stock Exchange, this new listing allows greater access to investors in Asia, targeting markets in Singapore, Hong Kong, and mainland China.

Nio Share Price Outlook

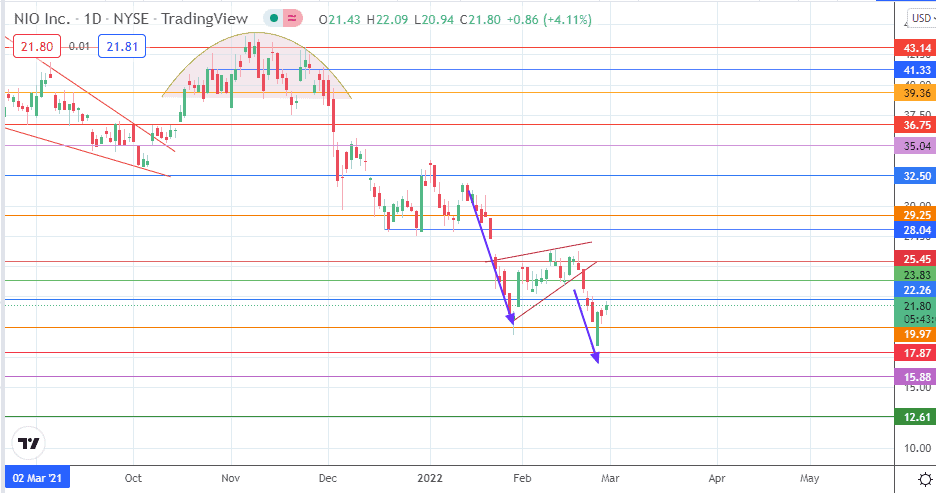

Following the recovery that succeeded the completion of the bearish pennant on the daily chart, the Nio share price has met resistance at the 22.26 price mark. The bulls need to remove this barrier for the recovery to continue towards 23.83. Above this level, additional obstacles to the upside are seen at 25.45 and 28.04. Additional resistance barriers at 29.25 and 32.50 complete potential short-term targets to the upside.

On the flip side, rejection at 22.26 could precipitate a resumption of the selloff. Any such selling would contend with immediate downside targets at 19.97 and 17.87, before 15.88 (4 September 2020 low) becomes an additional target to the south. If the slide is extensive, the 14 August low at 12.61 could also potentially enter the picture.

Nio: Daily Chart

Follow Eno on Twitter.