- The new Revuto subscription model, based on NFTs, could be the new trigger for Netflix stock price forecasts.

The Netflix stock price forecasts are yet to assume a direction due to the range-bound price action on the stock. There has been little trading activity on the stock in the last two sessions, as the low volumes indicate. However, the stock is still in positive territory for the week, having begun trading at a low of 170.30 on Monday.

The company continues to make inroads into new territory as it seeks to explore additional revenue options following a significant loss of its subscriber base to rivals Apple TV and Disney +. One avenue is letting companies offer NFT subscription slots on its network.

Just today, Revuto, a Croatian subscription management startup, has launched a lifetime digital subscription for both Netflix and Spotify using NFTs. The service will kick off 11 June. Each subscription will cost $349 and will be available for purchase via credit/debit cards and cryptos.

The Revuto deal has a potential advantage for Netflix: offering a seamless payment method for users in overseas markets where conventional payment channels remain a hassle. Not everyone can access a bank account or a credit/debit card, but a smartphone gives access to crypto to pay for NFT-based subscriptions. The subscription NFT can be flipped for a profit, which is a win-win case for all.

Netflix Stock Price Forecast

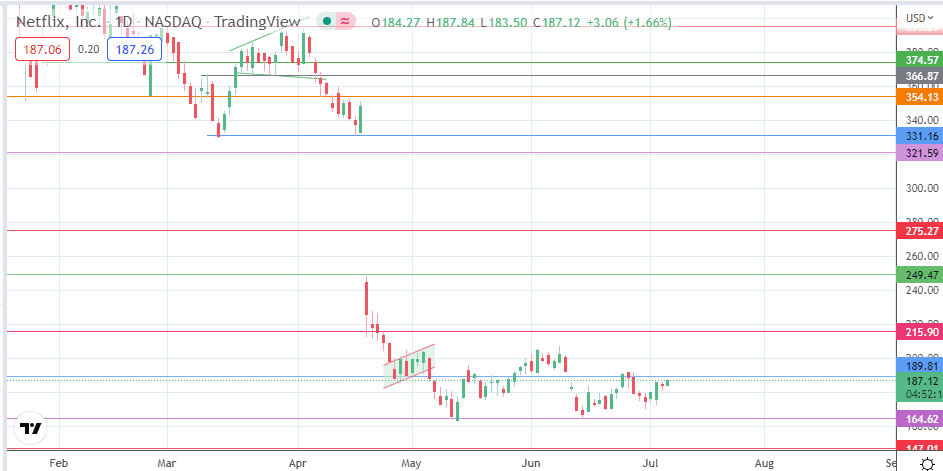

Technically speaking, the price action is ranging, with 189.81 serving as the ceiling and 164.62 acting as the floor of the range. The Netflix stock price forecasts will follow the direction of the resolution of this range.

A break of the 189.91 price ceiling (20 May and 24 June 2022 highs) will clear the pathway for the bulls to access the 215.90 resistance mark (25 April high). Above this level, the 249.47 price resistance will follow suit as another northbound target. The price action would need to clear this barrier and the resistance marks at 275.27 and 321.59 to cover the downside gap of 20 April.

On the other hand, the bears would need to take out the support at 164.62 to engage the 147.01 price mark (27 March 2017 high and 6 July 2017 low). Further price deterioration lets the bears glide toward 129.84. 111.31 is another harvest point for the bears, being the previous low of 14 November 2016.