NatWest share price has not been spared by the recent sell-off of UK bank stocks. The NWG stock price tumbled to a low of 245p, which was the lowest level since July 28. It has crashed by over 13% from the highest point in August. Other bank stocks like Lloyds, Barclays, and HSBC have all pulled back lately.

UK economic challenges

NatWest, formerly known as Royal Bank of Scotland, is a high street bank that owns some of the top brands in UK banking. It has over 19 million customers. Some of its top brands are companies like Coutts, which is known for banking for Queen Elizabeth.

It also owns Ulster Bank, Drummonds, Lombard, and Isle of Man Bank among others. The UK government, its biggest shareholder, has started selling its stake. It expects to exit it fully in the next few years.

NatWest business has been doing well, helped by the significantly higher interest rates. The company’s operating profit before tax for the first half of the year was £2.83 billion. Its income growth was 16.2% while the company set aside £1.75 billion for a special dividend.

The bank will likely benefit from high-interest rates as UK inflation is expected to skyrocket. Analysts expect that the country’s inflation will soar to 13% in October. In a warning report, analysts at Goldman Sachs warned that inflation will peak at 22% because of the soaring energy prices. Therefore, analysts believe that the BoE will need to hike interest rates dramatically in the coming months.

However, the soaring inflation will likely have a negative impact on the bank since it will need to spend more money also. For example, it could be forced to hike wages and spend more money on energy. Also, the bank is set to suffer as the British pound crashes.

NatWest share price forecast

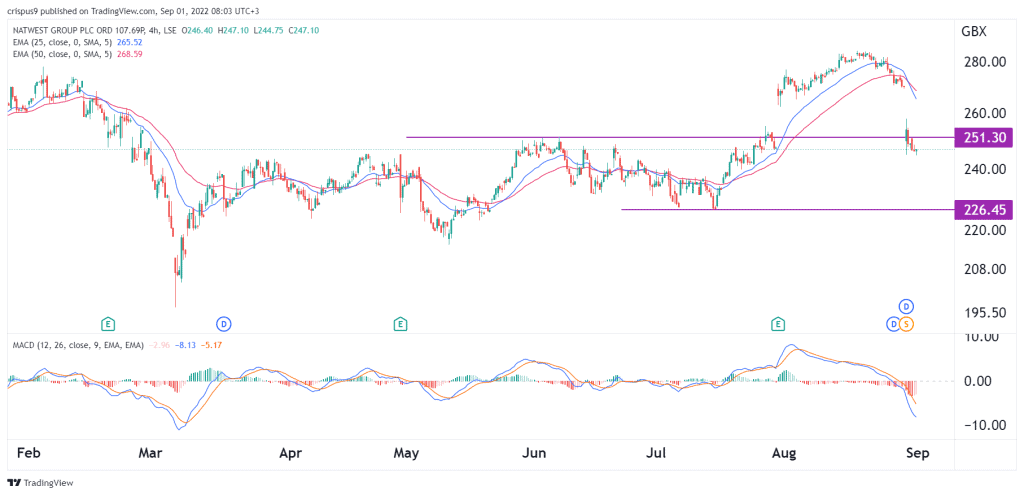

The four-hour chart shows that the Natwest share price made a strong down-gap after the firm was fined by CMA to businesses. The regulator forced them to open fee-bearing accounts. As it crashed, it managed to move below the important support level at 251.30p, which was the highest point on June 6.

The 25-day and 50-day moving averages made a bearish crossover while the MACD dropped below the neutral line. Therefore, the shares will likely have a bearish breakout as sellers target the next key support at 226p. A move above the resistance at 251p will invalidate the bearish view.