- The Nasdaq 100 index is sharply lower as the market opens due to recession fears and risk aversion ahead of the FOMC minutes release on Wed.

The Nasdaq 100 index looks set to begin the trading session negatively as risk aversion dominates the trading session across global stock markets. The risk-sensitive Nasdaq 100 index futures are down 0.82% presently, after losing earlier gains made in the session.

Fears of a global recession are dominating market activity as the Fed is set to release the minutes of its last meeting on Wednesday. In that meeting, the Federal Reserve blew market expectations out of the water when it delivered a 75 bps rate hike. Various FOMC policymakers have declared that only aggressive inflation control via rate hikes was good enough. The bets are on for an additional 75bps rate hike at its 28 July meeting.

The Nasdaq 100 index has had a poor run in the first half of 2022, as the withdrawal of extraordinary market and financial system support by the Fed hits the US markets. Only six stocks in the Nasdaq 100 had a positive ending to Q1 2022, with 30% of the Nasdaq 100’s value wiped out. The trend looks set to continue as the Fed tightens the screws even more.

Nasdaq 100 Index Outlook

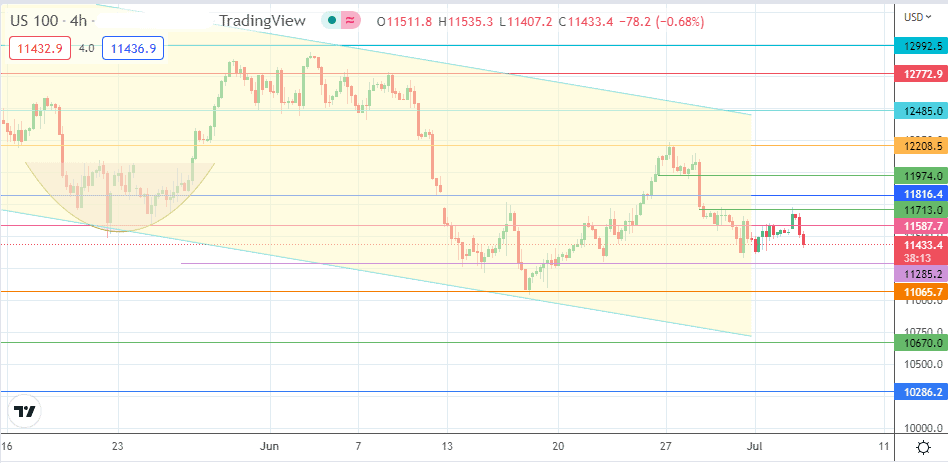

The drop in the US100 index looks set to continue after the rejection at the 11713.0 resistance. This drop has degraded the support level at 11587.7. The next target lies at the 11285.2 price mark (22 June low), leaving 11065.7 and 10670.0 as the additional downside targets.

Conversely, the 11713.0 price level is the price mark to beat for the bulls. A break of this area opens the path toward the 11816.4 resistance (10 June low). Additional targets to the north lie at 11974.0 and 12208.5, where the price high of 27 June 2022 is found. 12485.0 and 12772.9 are additional upside targets that presently remain unviable.

US100: Daily Chart