The Nasdaq 100 futures are trading lower this Tuesday, but the market retains a bullish tone, having cleared a critical resistance in Monday’s trading session. The Nasdaq 100 index shrugged off the risk-off sentiment brought on by weak Chinese data on Monday and posted a 0.74% increase.

This added to Friday’s gains of 1.74%, posted after a higher-than-expected figure for the US Consumer Sentiment index as measured by a University of Michigan survey. The recent gains in the Nasdaq 100 index have followed the cooling of inflation in the US on the consumer and producer ends of the supply chain.

However, this recent rally will be tested on Wednesday when the US Retail Sales and the July FOMC meeting’s minutes hit the wires. Retail sales in the US are expected to have slowed considerably, while the FOMC’s minutes will provide a glimpse into what the Fed could do regarding interest rates in its September 2022 meeting.

On the day, the Nasdaq 100 index is expected to respond to the performance of US long-term bond yields and corporate earnings from retail giants Walmart and Home Depot. Walmart’s second-quarter earnings and revenue beat estimates, even as it is seeing more pressure on its profits.

Nasdaq 100 Index Forecast

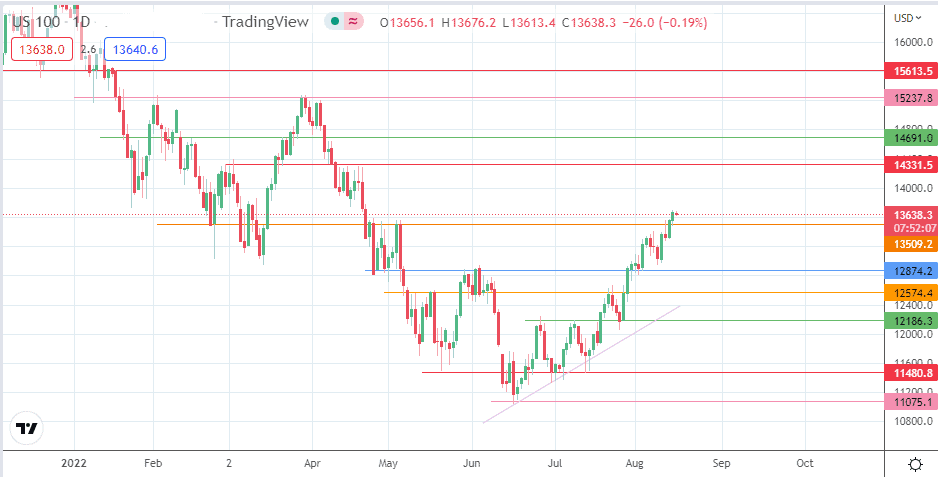

The closing penetration above the 13509 resistance and the rejection of the return move by Monday’s daily candle confirm the breakout move above this level, converting it to new support. This move gives the bulls clear skies to target the 14331 resistance, where the highs of 1 March and 20 April are found. If the bulls uncap this resistance barrier, 14691 (16 February and 22 March highs) becomes a new upside target. Above this level, additional upside targets are seen at 15237 (29 March high) and the 15615 price mark (18 January 2022 high).

On the other hand, a decline below 13509 truncates the upside move and opens the door for a correction toward 12874 (27 April and 3 August 2022 lows). A further decline takes out this pivot and makes 12574 the next downside target. Finally, 12186 (8 July high and 27 July low) and 11480 (4/13 July 2022 lows) form additional targets to the south if the correction is much deeper than expected.

Nasdaq 100: Daily Chart