- The Nasdaq 100 index is facing the prospect of an additional decline as China plans to extend COVID-19 restrictions.

The Nasdaq 100 index is up for the 2nd day in a row, albeit with low volumes as the risk-sensitive index aims to recover from recent big drops.

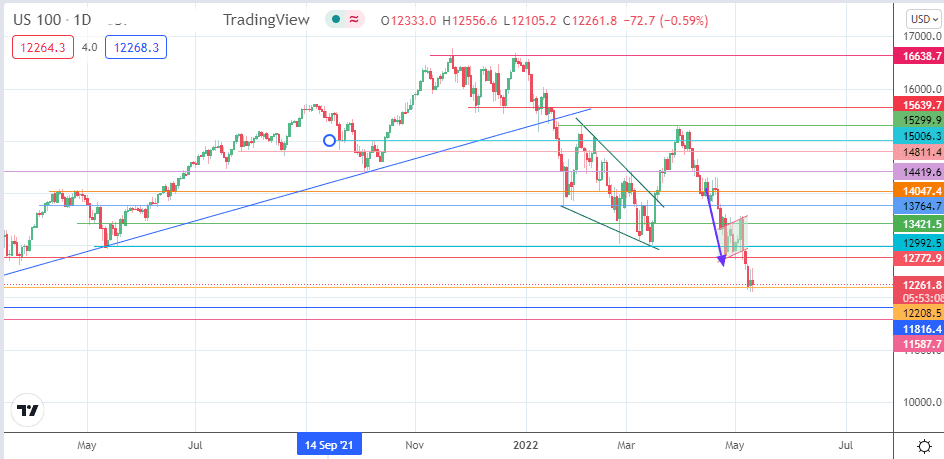

The initial selloff came after the Fed’s 50bps rate hike and Non-farm Payroll data that paved the way for additional rate hikes by the Fed. Wednesday’s trading session has remained choppy, with price action oscillating between positive and negative territory. This is showcased as the doji candle on the daily chart, sitting just above the 12772.9 support level.

Despite the mild gains of the last two sessions (today’s session inclusive), the Nasdaq 100 index could face new headwinds after authorities in China said they would impose stricter COVID-19 control measures as the Shanghai lockdown enters its 7th week. New cases of the Omicron variant of COVID-19 continue to surge in China despite the strict lockdown.

There are reports of authorities inspecting nearly 800 buildings as they seek for active cases. Chaoyang District is one of the areas which has seen mass testing of residents, with residents of Beijing set to undergo mass PCR testing even as the government has closed all entertainment centres.

The situation poses a challenge for several tech stocks listed on the Nasdaq with offices and businesses in China.

Nasdaq 100 Index Outlook

The recent decline is the measured move from the breakdown of the bearish flag at the 12772.9 support. This measured move requires the bears to take down the 12208.5 support (8 December 2020 and 5 March 2021 lows) to attain completion at the 11816.4 price mark (18 November 2020 low). An additional downside pivot at the 11587.7 support (10 November 2020 low) becomes available if the decline continues below the pattern’s completion point.

Conversely, if the bulls can exert greater momentum to push the bounce higher, 12772.9 becomes the initial upside target. 12992.5 (15 March 2022 low) becomes available if the bulls successfully uncap the barrier at 12772.9. Additional upside targets at 13421.5 (29 April high) and the 22 April high at 13764.7 become available on a continuation of the advance. 14047.4 (16 March high) is presently out of reach, but a break of 13764.7 to the upside makes this barrier a viable target for the bulls.

Nasdaq 100: Daily Chart

Follow Eno on Twitter.