The Nasdaq 100 index crashed to the lowest level since May 10th as investors refocused on the ongoing quarterly earnings. It also declined sharply as the US dollar index surged to the highest level since 2020 and the fear and greed index edged close to the extreme fear level. As a result, it has dropped by more than 23% from its highest level this year.

Fear and greed index crashes

Investors are getting fearful as the earnings season continues. While most companies have announced better-than-expected results, some have shown intense weakness. For example, Alphabet published weak quarterly results on Tuesday as its advertisement business declined. As a result, the Google stock price has crashed by over 3% in extended hours. As a result, other tech firms like Meta Platforms and even Twitter crashed.

The Nasdaq 100 index also fell as the Tesla stock price fell by more than 12%, as worries about Elon Musk’s buyout of Twitter remained. Investors expect China to have the upper hand on Tesla if the deal closes. Besides, China is the biggest market for Tesla cars. It is also the biggest supplier of batteries to Tesla.

Other Nasdaq 100 stocks that crashed hard on Tuesday were Lucid Group, Okta, DocuSign, CrowdStrike, Intuit, and AMD, among others. In addition, the Netflix stock price continued its sell-off, bringing its total market cap to about $88 billion.

The key stocks to watch will be PayPal, Checkpoint Software, Humana, Spotify, Pinterest, and Meta Platforms, among others.

Nasdaq 100 forecast

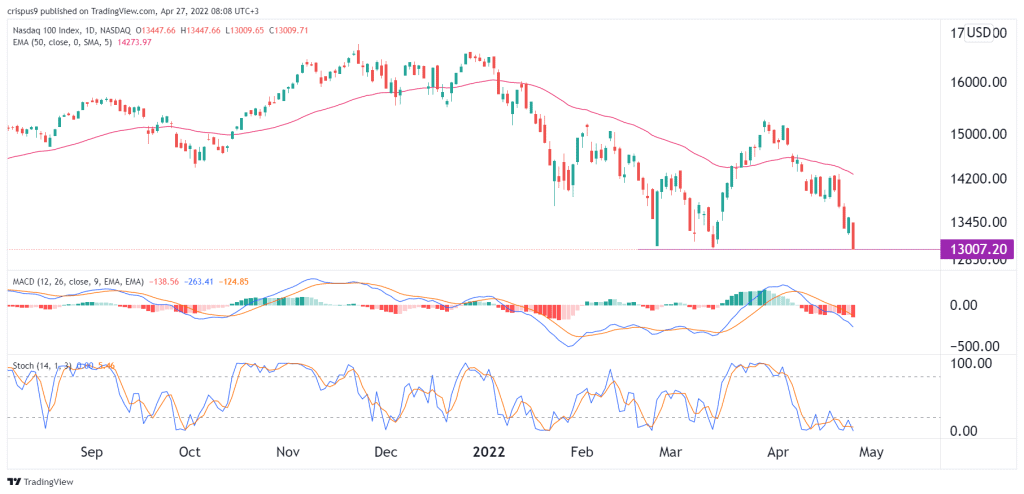

The daily chart shows that the Nasdaq 100 index has been in a strong bearish trend in the past few days. Now, the index is trading at the important support level of $13,000, which was also the lowest level in March. In addition, it has moved below the short and long-term moving averages while the MACD and the Stochastic oscillators have also retreated.

Therefore, the index will likely continue the bearish trend as bears target the next key support level at $12,500. A move above $13,500 will invalidate the bearish view.