- The Dow Jones and Nikkei 225 are bouncing back today but there are still risks of a pullback. The euro is strong after ECB while crude oil price is falling.

Asian stocks are mixed today, a day after the Dow Jones, S&P 500, and Nasdaq 100 ended sharply lower. The three indices declined by 1.45%, 1.75%, and 2%, respectively. In Japan, the Nikkei 225 index is up by 0.75% as traders react to news that large Japanese firms’ sentiment has turned higher for the first time in months. This sentiment rose to plus 2 in the third quarter after plummeting to -47.6 in the second quarter.

However, the Nikkei 225 index is reacting to a statement by Yoshihide Suga that he will hike the consumption tax again in a bid to improve the country’s fiscal health. This move will hit Japan hard considering that the previous tax hike pushed the country into a recession. Among the biggest gainers in the Nikkei are Rakuten, Yamaha, and Seiko Epson while the main laggards are Suzuki and Shinsei Bank.

Elsewhere, in Europe, futures tied to the DAX index are up by 0.45% while those tied to the FTSE 100, CAC 40, and Stoxx 50 are down by 0.35%, 0.20%, and 0.25%, respectively. A likely reason for the weakness of European stocks is the ECB rate decision yesterday. While the bank left rates and QE unchanged, Christine Lagarde did not reiterate any measures to weaken the euro. Instead, she sounded a bit hawkish during the press conference. That has pushed the euro higher, which is negative for most European companies.

Meanwhile, crude oil price has continued to decline, with Brent and West Texas Intermediate (WTI) trading below $40. The two benchmarks have dropped by more than 10% in the past week. The price dropped after data from EIA showed that inventories in the United States rose by more than 2 million barrels in the past week. That was the first time in eight weeks that inventories have risen. It was also worse than the 1.3 drawdown that analysts were expecting.

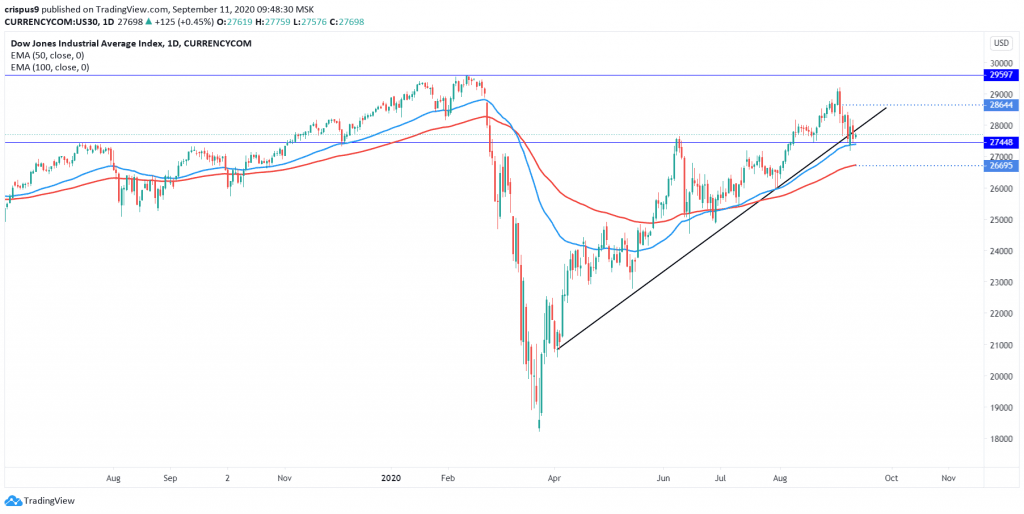

Dow Jones forecast

Dow Jones futures are up slightly today, a day after they dropped by more than 400 points. They are trading at $27,686, which is below August’s high of $29,000. On the daily chart, the price has also managed to move below the important ascending black trendline. It is also a few points above the 50-day moving averages.

Therefore, I suspect that the price will continue falling today as bulls target moves below $27,000. On the flip side, a move above $28,645 will invalidate this trend.