Litecoin price has performed very well in 2023. Since the start of the year, the price has surged more than 50%, outperforming most of the major cryptocurrencies. The latest analysis shows that LTC price prediction still remains bullish for 2023 as the holders await the network halving.

What is Litecoin and what is its purpose?

Litecoin was founded in 2011 by Charlie Lee as a Bitcoin fork. However, towards the end of 2017, the founder sold and donated all of his LTC tokens.

The crypto was introduced to the market as a ‘lite version of Bitcoin’. The development team sought to make transactions cheaper and faster, which is one of the key pros of LTC.

Litecoin vs. Bitcoin

Bitcoin is often compared to gold. Subsequently, Litecoin is seen as its ‘silver’. On average, the verification of Bitcoin transactions takes slightly below nine minutes. This is significantly longer than the 2.5 minutes needed for Litecoin transactions.

Besides, the average cost of $0.023 for a Litecoin transaction is considerably lower than the leading crypto’s minimum of $2. In the future, these features may offer it an added advantage in its adoption for retail use.

Even with this competitive advantage, the crypto is often categorized in the same group as other altcoins as opposed to being viewed as an alternative to Bitcoin. From that perspective, Ethereum is the most preferred choice after BTC.

LTC price history

Litecoin price has had mixed returns in the past few years. The coin’s price initially rallied to an all-time high of $420 in December 2017 during the then-crypto rally. It then slumped by over 90% in 2018 as the Fed embraced a highly aggressive tightening policy. The next rally happened between March 2020 and May 2021, when it rose by more than 1,500%. Since then, the price has declined by over 79%.

Notably, the crypto market has expanded aggressively in the recent past. The launching of numerous digital currencies has seen Litecoin’s market share dwindle. By the end of 2017, it was ranked the fifth cryptocurrency by market capitalization. According to CoinMarketCap, it is now ranked 14th with a market cap of $6.2 billion.

Litecoin Recoils Before Halving

The network halving of the Litecoin blockchain is scheduled to occur in August 2023. This will reduce the mining rewards for LTC miners by half. Bitcoin halving shows that such changes put very positive pressure on the price. Therefore, analysts expect Litecoin price to perform well in the coming months.

Litecoin Price Faces Headwinds Amid High Rates

For the past 18 months, Us Federal Reserve has been constantly increasing interest rates which has increased the selling pressure on risky assets like cryptocurrencies and equities. Litecoin price is currently trading 79.2% below its all-time high. If the US Fed remains hawkish in the coming months, LTC price may have another leg down.

Interestingly, the impact that the hawkish stance has had on cryptocurrencies is comparable to that of other risk assets. Bitcoin, the leading crypto by market cap, has dropped its value by 62% since November 2021.

The downward momentum that has been defining Bitcoin price movements in the last few months is also observable in other cryptocurrencies, including Ethereum, Ripple, and Litecoin.

LTC vs stocks correlation

The correlation between cryptocurrencies and other risk assets has increased. In prior years, digital assets did not necessarily respond to the global policy in the same way as equities and other financial markets. However, investors are shifting their perception of crypto from a unique hedge against inflation to a typical risk asset. In the foreseeable future, Litecoin price will likely continue to move in tandem with the stock market.

Litecoin price prediction 2023

As described earlier, LTC has already been showing bullish price action since the start of 2023. In the coming months, investor interest in one of the pioneering cryptocurrencies is likely to remain high due to its halving in August 2023. Therefore, Litecoin price prediction of $200 can become a reality if the price reclaims the $105 resistance.

Litecoin price prediction for 2025

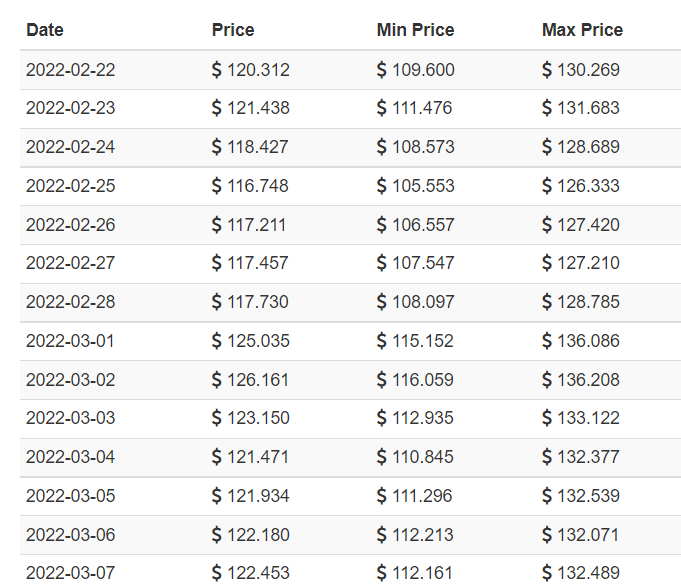

LTC price prediction, according to Wallet Investor indicates that the altcoin will likely record gains in the near term. The firm expects Litecoin price to be at $117.73 by the last day of February and rise further to $122.45 within a span of one week.

For long-term investors, one of the lingering questions is what will be Litecoin price in 2025. Seeing that Bitcoin often sets the path for altcoins’ price movements, it is possible to predict Litecoin price for the coming years based on Bitcoin price forecast by various credible analysts.

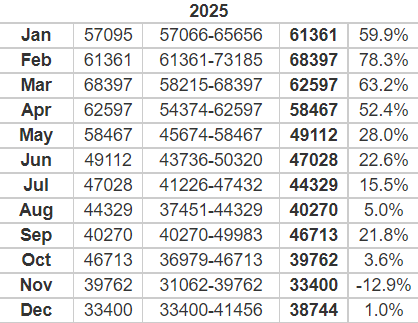

LongForecast expects the leading cryptocurrency to reach $61,361 as at January 2025 before pulling back to $47,028 by June and further down to $38,744 by year-end.

Based on the current prices, the BTC/LTC ratio is 352.29. If the current trend continues in the coming years, Litecoin price will likely open the year at $174.17, but decline to a closing price of $109.97 in December 2025. A look at this forecast for the period between 2022 and 2025 indicates that the crypto may not attract enough buyers to push it to December 2021’s level of $200.

LTC price prediction for 2030

It is somewhat difficult to predict Litecoin price for 2030 as crypto due to the high volatility associated with this class of financial assets. However, with increased adoption for retail use, it will likely rise significantly within a decade.

Will LTC reach $1,000?

Cryptocurrencies are largely characterized by heightened volatility. While Litecoin price will probably record significant gains in coming months, $1,000 is rather unlikely in the current decade.

How to buy Litecoin

One can purchase Litecoin via apps such as PayPal and Cash App. However, the more common approach is to use crypto exchanges like Coinbase, Binance, and Crypto.com. Regardless of the option you decide to use, it is helpful to consider the platform’s security, fees, and ease to use.