- Amazon Stock Prediction: The latest analysis reveals while NASDAQ: AMZN might not be a great buy right now, it can still be a good long term investment.

Amazon (NASDAQ: AMZN) stock price action is very difficult to predict in the current economic conditions. Amazon is one of the biggest and pioneering internet tech companies in the world. The tech giant was founded in 1994 by Jeff Bezos as Cadabra, Inc. in Washington.

Over the past three decades, the company has evolved from a garage-run business to one of the most valuable companies in the world. Let’s take a shot at Amazon stock prediction in the next few years.

You don’t have to be a stock market analyst to be able to tell how exceptionally well Amazon stock has performed this year. A 78% yearly surge for a multi-trillion dollar company like Amazon Inc. is quite extraordinary, to say the least.

What Is Amazon Stock Price?

Amazon stock is listed on the NASDAQ stock exchange, which is the second biggest stock exchange in the world. The shares trade under the ticker NASDAQ: AMZN. The current Amazon stock price is $145. This puts the company at a market capitalization of $1.38 Trillion. This makes it the fourth biggest company in the world.

This Amazon stock forecast was originally published on November 25, 2023, and is regularly updated to reflect the latest price action, earnings, and macro trends.

Amazon Gets Sued By FTC For Price Inflation

In one of the most recent developments, the Federal Trade Commission (FTC) filed a lawsuit against Amazon on 26 September 2023. According to the regulator, the pioneering e-commerce platform allegedly leveraged its monopoly to inflate the prices of several products. Amazon stock price has been experiencing increased selling pressure since the news.

However, the company has responded to the lawsuit, suggesting that this may impact its ability to serve its customers effectively. According to Amazon’s top executive David Zapolsy, the lawsuit may result in slower deliveries for the customers and higher prices.

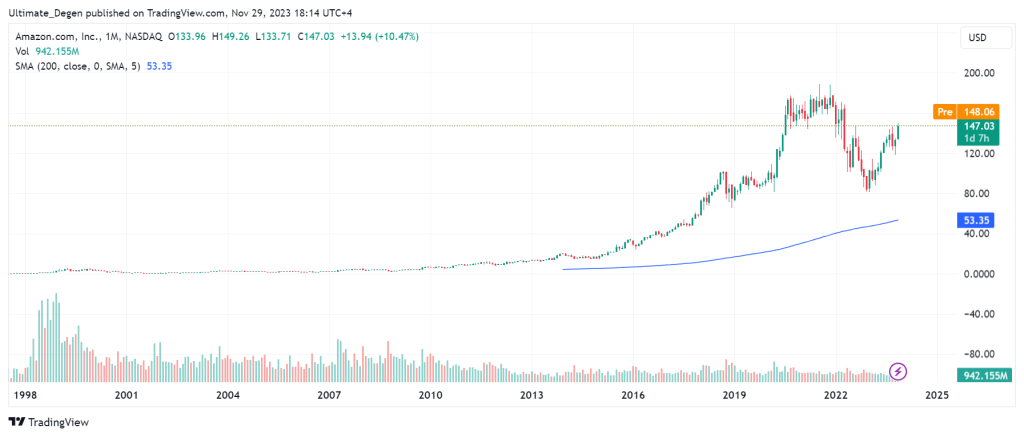

Amazon Stock Price History

I’ll keep sharing my updated price outlook on Amazon & other stocks in my free Telegram group, which you’re welcome to join.

Amazon Stock Latest News

The ongoing hawkish stance of the US Federal Reserve may change as inflation is cooling down in the United States. According to the recently released October 2023 CPI data, the YoY inflation came at 3.2%. This was slightly lower than the market forecast of 3.3% and resulted in a strong surge in US equities, including Amazon shares.

Amazon has recently released its Q3 earnings in which the tech giant reported $143.1 billion in revenue. This was a 13% increase from last year. Additionally, the company also generated $9.9 billion in net income which was a phenomenal 240% surge from last year’s figure.

The third quarter results were taken very well by the markets as the stock price rebounded from $118.35. Since then, Amazon stock has been up 12.3% and is aiming for more upside.

Amazon Share Price Technical Analysis

NASDAQ: AMZN chart shows that the price has broken above the $146 resistance level, but bulls are struggling to gain momentum. There also seems to be a rejection from the 0.618 fib retracement level which lies just a few points above this resistance level.

Amazon stock price forecast may turn very bullish if the price gains strength above the $146 level. This may trigger another rally towards its next resistance of $160. On the other hand, a breakdown below $146 will invalidate the bullish outlook, putting lower price targets on the cards.

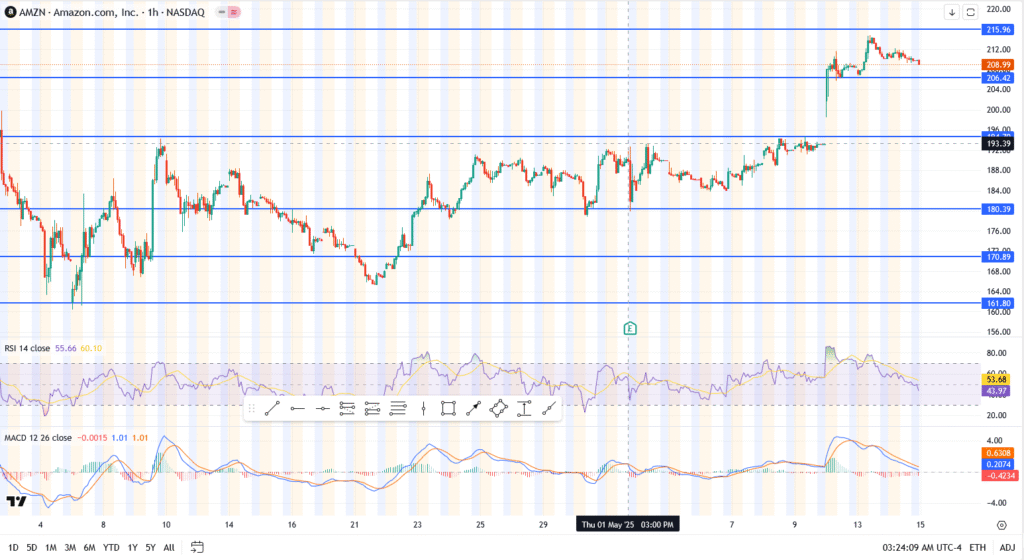

This update is for Thursday, May 15, 2025.

Amazon Stock Price Today: AMZN Pulls Back After Earnings Spike, But Bulls Still in Charge

Amazon shares are cooling off slightly this Thursday, trading around $209 after a big earnings-driven breakout earlier in the week. While the post-earnings surge pushed AMZN past the $206 level, the price has since drifted lower, not unusual after such a strong run.

At the time of writing, AMZN is holding gains well above previous resistance, suggesting buyers are still present even as momentum eases.

AMZN Technical Levels

- Support at $206.42 — former resistance, now acting as a pivot zone

- Short-term resistance capped around $215.96, which remains untouched since the breakout

- Below $206, next major support is $196, last month’s key range top

- RSI at 55.66, fading slightly but still bullish

- MACD is rolling over — early signs of weakening upward momentum

This isn’t a breakdown, just a pause. So far, no major selling pressure has shown up.

What’s Driving Amazon Stock This Week?

The strong Q1 earnings report lit a fire under AMZN. Cloud revenue beat estimates, Prime subscriptions rose, and advertising continued its steady growth. But with markets now shifting focus toward upcoming Fed commentary and consumer sentiment data, traders seem cautious about chasing the rally higher, for now.

Also worth watching: tech peers like Microsoft and Google are holding up, but not pushing higher. That broader pause might be keeping Amazon in check too.

Final Word: Still Strong, But Watch $206

As long as AMZN stays above $206, the bulls have control. If that level breaks, things could get messy, especially with the next support not until $196. But if buyers step back in and reclaim $215.96, this could just be the start of another leg up.

Keep it on your radar pullbacks like this often offer opportunity.

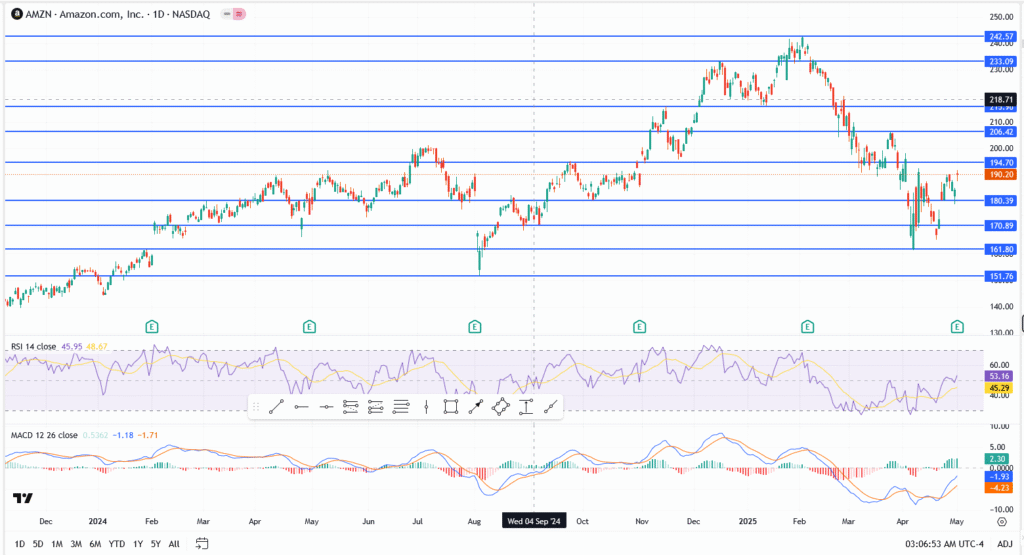

Amazon Stock Price Prediction – Can AMZN Break Above $194 After April 2025 Wild Ride?

Amazon hasn’t had the best run so far this year. After hitting a peak near $233 back in late 2024, the stock pulled back hard, dropping as low as $161. That’s a steep fall for a name like this. As of May 2, AMZN is clawing its way back, trading around $190, still off the highs, but holding ground.

Investors have been cautious. Slower AWS growth, weaker guidance last quarter, and stubborn operating costs have all put a lid on upside. The story hasn’t changed. Amazon is still a tech heavyweight, but it’s not getting the same premium it once did.

Technical Setup: Can AMZN Break Through $194?

Amazon is flirting with a key level at $194.70. That’s the line it needs to clear to show it still has gas in the tank. Above that, $206.42 and $218.71 are in play. Below, watch for support around $180.39, and deeper down, $170.89.

- Price now: $190.20

- Next resistance: $194.70, $206.42, $218.71

- Support zones: $180.39, $170.89, $161.80

- RSI: Just under 46 — nothing stretched

- MACD: Flipping positive, but barely

Right now, it’s a waiting game. A clean breakout over $194 could trigger a run. But if that level holds as a ceiling, Amazon might stay trapped in a sideways grind.

What’s Holding Amazon Back in 2025?

AWS growth is cooling. It’s still a beast, but the double-digit expansion days are slowing. That’s made analysts rethink their future multiples.

Margins are tight. Amazon has been fighting logistics inflation and delivery cost pressures since 2022. Automation helps, but it’s not a silver bullet.

Advertising is solid, maybe even underrated. The ad division has been one of the few consistent bright spots, and it’s growing faster than most people realise.

AI is a work-in-progress. There’s money going into generative AI through AWS, Alexa, and internal tools. But the Street wants results, not just vision.

Regulation risk hasn’t gone away, even if the headlines have. The FTC is still circling, and that long-term noise is hard to ignore.

April 2025 Recap: A Whiplash Month for AMZN

April was messy. The stock kicked things off near $194, but one earnings call later, it was trading at $161. The drop was sharp, driven mostly by soft guidance and AWS slowdown. But bulls didn’t give up. Buyers stepped in fast, pushing the stock back to $190 by the end of the month.

That’s a 17% rally off the lows. It’s not nothing. But Amazon didn’t end April in a better spot than where it started; it was just back where it was before the breakdown.

May 2025 Outlook: Breakout or Backtrack?

If AMZN can finally push through $194.70 with volume, it opens the door to $206+. But without a fresh catalyst, that breakout could stall again. Any more signs of margin compression or slowing AWS growth might send the stock right back to $180.

This month will come down to data: inflation prints, Fed talk, and updates from Amazon’s retail and cloud arms. It’s not a bad setup. But it’s not a sure thing, either.

Long-Term View: Is AMZN Still a Buy in 2025?

Amazon still owns e-commerce in the U.S., it’s top-three in cloud, and its ad business is only getting bigger. If you’re a long-term investor, the fundamentals are intact even if the growth curve is flattening out.

It’s not the high-flyer it used to be, but it’s not broken. If the stock dips below $180 again, plenty of fund managers will be lining up to reload. Just don’t expect fireworks overnight.

Amazon Stock Prediction 2030

To be honest, Amazon stock prediction 2030 is anybody’s guess. Nobody knows how the ongoing Ukraine conflict could’ve ended by then. The ongoing power struggle between US and China could’ve further intensified by then. Nevertheless, if Amazon keeps innovating and maintains a strong global footprint, we may see the stock hitting news all-time highs before 2030.

Amazon Stock Prediction 2040

To predict the price action of any stock for 2040 is really a shot in the dark. By that time, we might have seen a lot of innovations in the realms of artificial intelligence, blockchain, and metaverse. If Amazon keeps itself at the cutting edge of these growing fields, it can maintain its stronghold in the tech world by 2040.

Nevertheless, many innovative companies that are currently nowhere close to Amazon may give it a run for their money in the coming years. Therefore, it is very risky to bet on any business considering such a broad time horizon.

Is Amazon A Good Investment?

Amazon stock price is currently 38% down from its 2021 all-time high. Considering the hawkish Fed policies and high interest rates. The stock seems to be overvalued at the moment. It seems pretty logical to wait for a Fed pivot or another major pullback in US equities before buying any tech stocks right now. However, from a long-term perspective of 3-5 years, the stock still seems to be a good investment.

It is also worth mentioning here that for tech giants like Amazon to thrive, the whole global economy needs to expand at a rapid pace in the coming year. This might not be the case if the US Federal Reserve fails to deliver a soft landing in 2024-2025.

How To Buy Amazon Shares?

You can buy Amazon shares from any reliable online broker. These brokers provide different investment products to gain exposure to Amazon stock from the comfort of your home. You just need to go to a physical stock exchange to buy the shares. Robinhood, Exness, TD Ameritrade, Fidelity, and Interactive Brokers are some of the most popular online brokers.

Is Amazon Stock A Good Buy?

While Amazon stock prediction is not bullish for the coming months, the stock can still perform great in the coming years. Therefore, one must decide the timeframe of investment in Amazon shares before buying.

Conclusion:

Amazon stock price appears to be very hot right now due to strong earnings and revenue in the first quarter of 2023. However, the deteriorating US economy may trigger another pullback soon. Furthermore, the upcoming decisions of the US Federal Reserve will also keep the equity prices in check during the rest of the year. As it is with any other stock, you need to determine the objectives and the time frame for your investment before buying.