- The Lloyds share price has been in a tight range in the past few days. The stock is trading at 42.41p. What next for LLOY?

The Lloyds share price has been in a tight range in the past few days. The stock is trading at 42.41p, where it has been in the past few days. It has risen by about 3.25% above the lowest level in June. However, it is also about 21% below the highest point this year, meaning that the shares have moved to a bear market. Other UK bank stocks like Barclays and HSBC have also struggled lately.

Bank of England rate hike

The LLOY stock price has dropped sharply in the past few months as investors remain concerned about the UK economy. Recent data shows that the economy has started to unravel as inflation surges.

On Thursday last week, data by Nationwide showed that house prices dropped in June as demand started easing. However, the average house price rose to a high of 271,613 even though the trend has waned. Prices rose by 10.7% after rising by 11.2% in the previous month.

Further data showed that the country’s consumer confidence dropped to a record low. Confidence has dropped sharply because of the ongoing stagflation. Inflation has surged to the highest level in more than four decades.

Therefore, it seems like investors worries about a slowdown of the economy has outweighed the impact of higher interest rates. The Bank of England has already hiked interest rates in the past five meetings. Still, there is a sign that the Lloyds share price is undervalued. The company has a PE multiple of 5.6x, which is lower than that of NatWest.

It is also below that of Standard Chartered, HSBC, and other banks. Most importantly, European stocks have an average PE of 8.6x. Most importantly, the Lloyds stock price is about 65.2% undervalued according to a DCF model, as shown below. Therefore, the fair value of the stock is 122p, giving it a price-to-earnings vs fair value of 10.6x.

Lloyds share price forecast

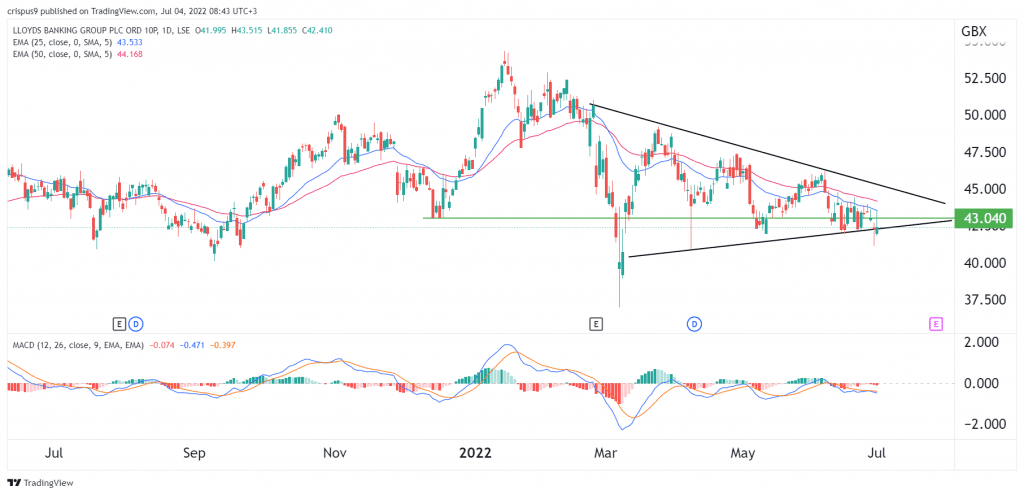

The daily chart shows that the LLOY share price has narrowed in the past few days. The stock has formed a symmetrical triangle pattern. The shares have moved slightly below the 25-day and 50-day moving averages. The MACD has moved slightly below the neutral point.

Therefore, with the triangle nearing its confluence level, there is a possibility that it will have a bearish breakout in July. If this happens, the next key support to watch will be at 40p. A move above the resistance at 45p will invalidate the bearish view.