- What is the outlook for the Lloyds share price for May 2022? We explain what to expect now that the company had strong results.

The Lloyds share price popped this week after the company published strong results and boosted its forward guidance. LLOY shares rose to a high of 47.50p, the highest point since the first week of the month. The shares are about 20% above the lowest level this year. Other UK banks like Barclays, Standard Chartered, NatWest, and HSBC published mixed results.

Lloyds earnings review

Lloyds Bank had a great quarter as the company benefited from high-interest rates and strong economic recovery. In a statement, the company said that its net interest income rose by 10% to 2.95 billion pounds in the first quarter. Net income rose by 12% to 4.11 billion pounds while costs declined by 2%. As a result, its statutory profit after tax declined to 1.2 billion pounds since last year’s Q1 benefited from provisions.

Lloyds also said its tangible net asset value per share was 56.5p, while its CET1 ratio dropped to 14.2%. The company said that it was seeing a healthy recovery from the pandemic even as the UK economy remained uncertain. In the first quarter, its loans and advances to customers rose to 451 billion pounds while customer deposits jumped by 4.8 billion pounds to 481.1 billion.

As a result, Lloyds share price rose as the firm boosted its forward guidance. It expects its net interest margin to be above 270 basis points while its operating costs will be 8.8 billion pounds.

Lloyds earnings were different from those of Barclays. Barclays said that its legal costs were rising in its report, which caused its profitability to decline sharply. However, its strong trading income was not enough to offset this performance. HSBC and Standard Chartered also warned about the slowing Asian business.

Lloyds share price forecast

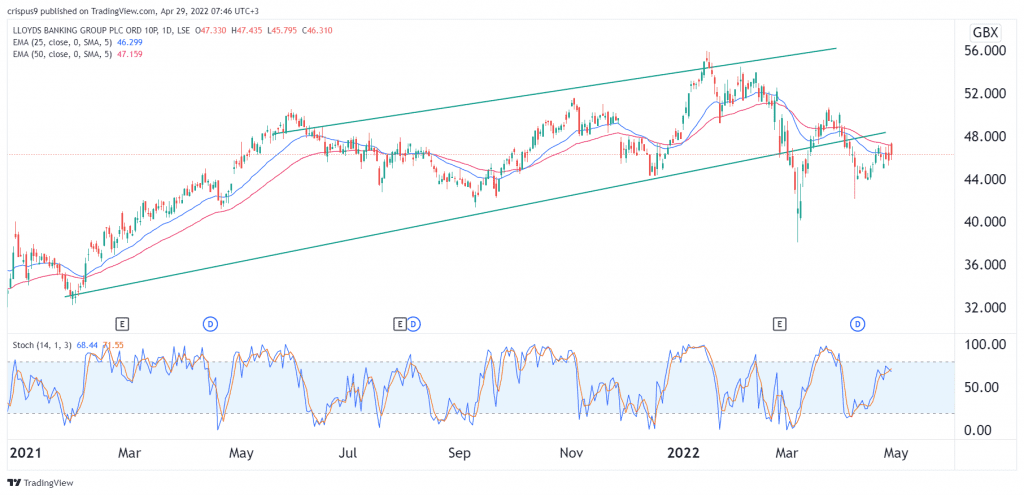

The Lloyds share price rose slightly after the company’s earnings. However, the tock remains significantly lower than its highest level this year. It is also slightly below the lower side of the ascending channel shown in green while the Stochastic oscillator has moved close to the overbought level. It is also capped at the 25-day and 50-day moving averages.

Therefore, the outlook for the stock in May is bearish since it has formed a break and retest pattern. If this happens, the key support level to watch will be at 42.37p. A move above the lower side of the channel will signal that there are still more buyers.