- Lido price has done relatively well in the past few weeks as investors wait for the upcoming Ethereum merge. What next for LDO?

Lido price has done relatively well in the past few weeks as investors wait for the upcoming Ethereum merge. The LDO price rose to a high of $1.9295, which is a few points above this week’s low of $1.5547. It has jumped by almost 400% from its lowest level in June, giving it a market cap of over $1.1 billion. Other top-performing cryptocurrencies on Tuesday were BURGER, LOKA, VGX, and UNFI.

Why is Lido DAO rising?

Lido DAO is a leading player in decentralized finance (DeFi). According to DeFi Llama, the platform has a total value locked (TVL) of over $6.7 billion, making it the second biggest DeFi platform in the world after Maker.

Lido DAO is a platform that provides liquidity for staked assets. The platform provides liquidity in chains like Ethereum, Polkadot, Solana, Kusama, Polygon, and Kusama. Lido Staked Ether, its biggest asset has a total market cap of over $6 billion. Similarly, Lido Staked SOL has a market cap of over $128 million.

Lido DAO price has jumped sharply following the collapse of Terra. Before its collapse, Terra was the second-biggest platform in its Lido’s ecosystem. Lido on Terra is now winding down since LUNA, and Terra USD have collapsed.

Lido price has done well in the past few weeks as investors cheer the strong rewards in its ecosystem. Lido on ETH have an APR of about 3.9%, while Polygon had an APR of 6.3%. It is Polkadot and Kusama have a yield of over 16%. It has also rallied because of the upcoming Ethereum merge event.

Lido price prediction

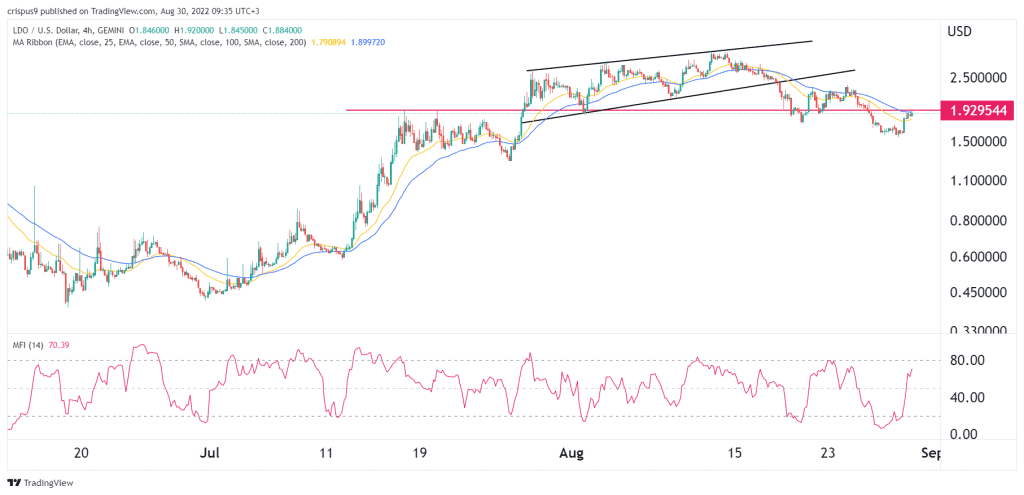

The four-hour chart shows that the LDO price was in a strong bullish trend since June this year. Most recently, the coin formed a rising wedge pattern that is shown in black. Historically, a rising wedge is a bearish signal, which explains why it has made a bearish breakout. As a result, the coin moved below the 25-day and 50-day moving averages. It also moved below the important support at $1.9295, which was the highest level on July 17 and 19.

Therefore, the Lido price will likely continue falling as bears target the important support at $1.00, which is about 50% below the current price. A move above the resistance at $2.50 will invalidate the bearish view.