- The Legal and General share price is crawling back as investors wait for the upcoming interest rate decisions by the Fed and the BOE

The Legal and General share price is crawling back as investors wait for the upcoming interest rate decisions by the Federal Reserve and the Bank of England. The LGEN stock rose to a high of 258p, slightly higher than last week’s low of 245p. The price is also about 14% above the lowest level this year, valuing the company at about 15.4 billion pounds.

Legal and General is a 186-year-old company that offers insurance, reinsurance, retirement, and investment management solutions in the UK and the US. The firm operates its business in a number of segments, including Institutional Retirement, Retail Retirement, Investment Management, Capital Investment, and Insurance. Its insurance division has over 9 million customers, while its investment management business has over 1.4 trillion pounds in assets under management.

Legal and General is invested mostly because of its high dividend. According to SeekingAlpha, the company has a dividend yield of 7.7% and a forward yield of 11%. This makes its dividend returns slightly better than those of Prudential and Schroders. However, the yield is slightly lower than that of Aviva Group. It is also substantially safe, considering that the company has a healthy payout ratio.

Legal and General is a good investment as interest rates keep rising. It means that it will allocate some of these funds to high-yielding assets, which is a positive thing. Two weeks ago, the company said its profit rose by 28% to over 2 billion pounds. In addition, its return on equity rose to 20.5%, while inflows jumped to over 34.6 billion pounds.

Legal and General share price forecast

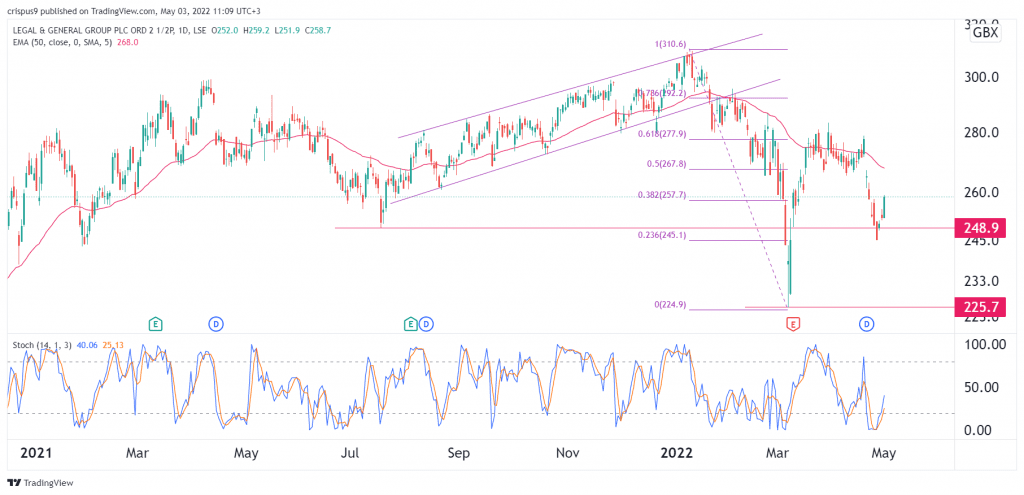

The daily chart shows that the LGEN share price has bounced back after falling sharply in the past few days. However, the shares remain below the 25-day and 50-day moving averages while the Stochastic Oscillator has moved above the oversold level. It also moved above the 38.2% Fibonacci retracement level.

In the near term, the stock will likely resume the bearish trend as investors target the important support at 250p. However, Legal and General is a good dividend stock to buy long-term.