- The Meta stock price has remained under intense pressure this week as concerns about the company remained. What next?

The Meta stock price has remained under intense pressure this week as concerns about the company remained. The FB stock is trading at $222.95, lower than this week’s high of $237. In addition, it has fallen by about 41% below its 2021 high of $384, bringing its market cap to $606 billion. At its peak, Facebook was valued at over $1 trillion.

Once a beloved name in tech, Meta Platforms has become a toxic brand among investors and even its customers. Many advertisers, especially those in the United States and Europe, have struggled to implement a marketing strategy due to the iOS upgrade. This upgrade made it possible for people to boost their privacy protections. As a result, as you can read in this WSJ article, many advertisers have dramatically reduced their Facebook marketing.

The Meta stock price has plummeted because of its additional concerns. For example, there are issues about the rising competition from companies like TikTok and Amazon. Amazon’s ad business grew to over $31 billion in 2021, which is a great figure considering that it was a relatively smaller business a few years ago. TikTok, on the other hand, has seen its revenue soar to about $61 billion.

The FB stock price declined this week after the Financial Times reported that Facebook was preparing to launch a metaverse platform. The company plans to launch virtual coins, tokens, and lending services to its applications as it seeks to offset its ad business. The metaverse platform has been dubbed Zuck Bucks. Unlike other open-source metaverse platforms like Decentraland, it will be a centralized platform like Roblox.

Still, it is too early to predict whether this project will be successful. Meta’s initial strategy to launch a digital currency known as Diem failed spectacularly. So, is Meta a good investment?

Meta stock price forecast

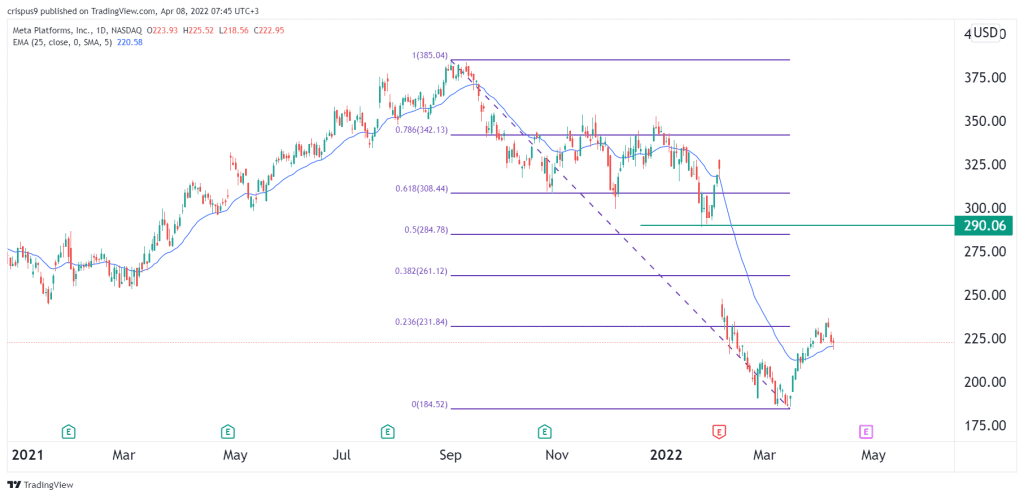

The daily chart shows that the Meta share price made a giant gap when it published weak results in Q1. Since then, the stock has struggled to bounce back. It has failed to move above the 23.6% Fibonacci retracement level. Also, it is hovering along the 25-day and 50-day moving averages. It also seems like it has formed an island reversal pattern.

Therefore, the stock will likely remain in this range as investors wait for the company’s earnings scheduled for April 27th. This means that the next 19 days will be crucial for the stock. Signs of improvement will push the shares sharply higher.