The Enjin Coin price is grappling with a significant support level, which may trigger a violent shock lower in the near future.

Enjin Coin (ENJ) is lower in Asian hours on Friday at $3.315 (-2.70%), around 35% below November’s $5.000 all-time high but holding a 325% gain from the July lows. The recent weakness has erased almost $1.2 billion from Enjin Coin’s market cap, placing it at #63 on Coinmarketcap’s cryptocurrency league table. The ENJ token is trading in line with other Metaverse and gaming tokens like Decentraland and The Sandbox and corrected from the highs. Several factors are weighing on the price right now. Firstly, the crypto market as a whole is lower following fed Chair Powell’s hawkish stance and the Omicron covid breakout. Secondly, the magnitude of the rally last month attracted profit-taking at the higher numbers. As a result, ENJ is testing, what I consider a critical support level, which, if broken, may force liquidations.

ENJ Price Forecast

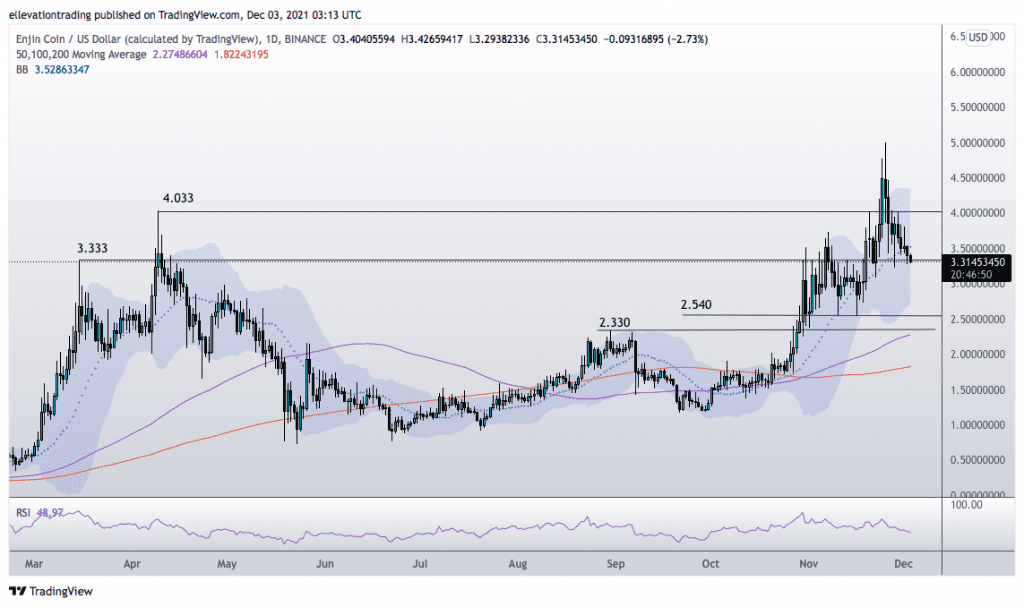

The daily chart shows the Enjin Coin price is testing the horizontal support of the former all-time high of $3.333. Notably, ENJ has pierced the support several times this week but closed above the level.

In my opinion, a daily close below $3.333 would suggest a breakdown, potentially targeting the support at $2.540. In contrast, if Enjin Coin holds above $3.333 and turns higher, it will reinforce the support level, likely leading to a return to $4.000.

Considering the downward momentum and the impressive performance last month, I favour the bearish scenario. However, it’s too early in the day to confirm the thesis. On that basis, I am on the sidelines until the daily candle is fully-formed.

Enjin Coin Price Chart (Daily)

For more market insights, follow Elliott on Twitter.