- The Diageo share price is set for a fourth straight week of gains as investors cheer the biggest insider purchase this year.

The Diageo share price is set for a fourth straight week of gains as investors cheer the most significant insider purchase this year. Shareholders in Diageo Plc (LON: DGE) already had enough reasons to reach for the champagne this year. By August, the drinks giant was up over 25% on the year, far outperforming the FTSE and erasing all of the covid pandemic losses.

Pubs and bars are booming again as thirsty patrons make up for the lost time. Diageo’s alcoholic brands, including Guinness and Smirnoff, have been filling up glasses as countries return to normality. As a result, the company has performed brilliantly in 2021. The company released an upbeat statement in September, highlighting the return to form:

“We have made a strong start to fiscal 22, with organic net sales momentum across all regions. This reflects excellent execution, as we benefit from resilience in the off-trade and continued recovery in the on-trade”.

However, maybe the most bullish catalyst for the Diageo share price is the recent stock purchase by Non-Executive Chairman Francisco Javier Larraz. Although the investment totalling £881k only increased Francisco Javier Larraz’s holdings by 9.8%, investors will be encouraged to hear he paid an average price of 3,525p. The share purchase should inspire investor confidence, which could push Diageo even higher.

DGE Price Forecast

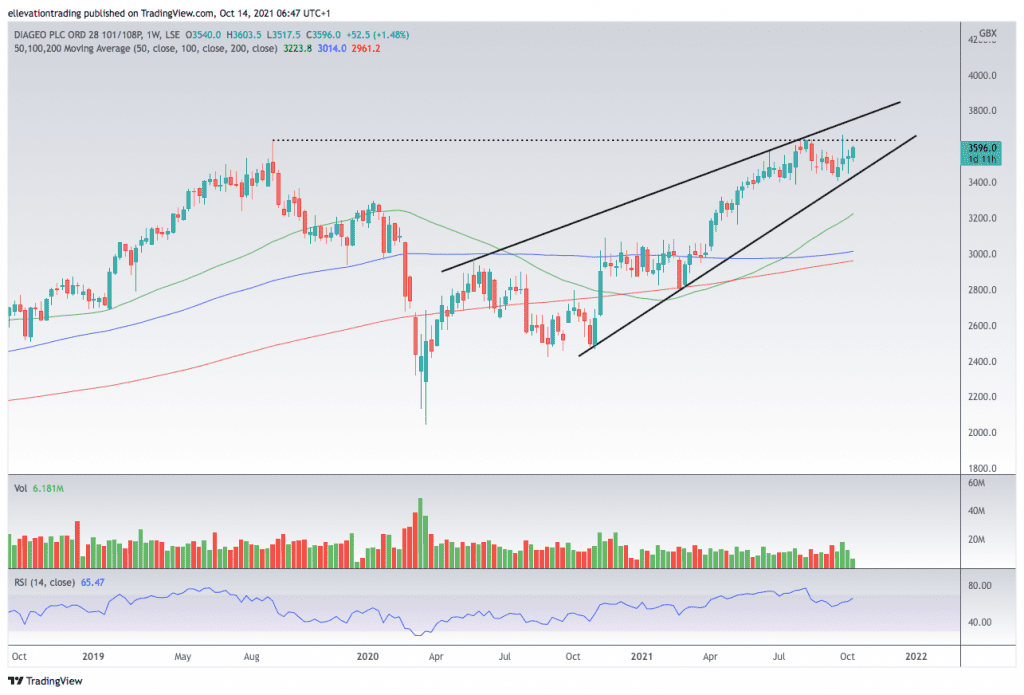

The weekly price chart shows Diageo is trending higher in a rising wedge pattern. The lower edge of the wedge offers support at 3,452p. Furthermore, the price is heading towards the recent 3,666p high. The high from September marginally beat the 2019 peak to set the all-time high price. Therefore, 3,666p is a significant resistance level. If the share price extends to set a new record, the top edge of the wedge at 3,750p is a logical target. Furthermore, as global vaccination rates increase, the price could achieve the hoped-for 4,000p valuation.

However, apparent headwinds remain. The first is that equities valuations are lofty, and the recovery trade is well underway. Furthermore, increased US taper odds and a 2022 interest rate hike may take some wind from the sails of equities. On that basis, I maintain an optimistic view, as long as Diageo respects the rising wedge. Therefore, if the price closes below 3,452p, it will invalidate the bullish thesis.

Diageo Share Price Chart (Weekly)

For more market insights, follow Elliott on Twitter.