- IEA projects lower global crude oil demand, citing concerns from US-China trade war. Demand for crude oil from Jan-May at its lowest levels in 11 years,

The latest oil market report was released earlier today by the International Energy Agency (IEA), and the projections do not look positive for crude oil producers. The IEA has lowered its forecasts for crude oil global demand, citing the dampening of economic activity from the ongoing US-China trade war.

Highlights of the report show that global demand for crude oil in May fell on an annualized basis by 160,000 barrels per day, while crude oil demand by the OECD countries dropped for three straight quarters for the first time in 5 years.

The IEA report also shows that crude oil supply from non-OPEC countries grew by 1.4million barrels in July on an annualized basis and is projected to increase by 1.9million and 2.2million barrels per day in 2019 and 2020. Demand for crude oil from the OPEC bloc is projected to rise in Q3 2019 to just over thirsty and a half million barrels per day, nearly a million barrels over current production. Crude oil demand on a global basis also rose by its slowest margins for the first 5 months of the year in a more than a decade.

Technical Plays for Crude Oil

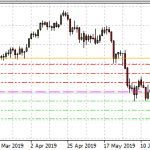

WTI crude was able to make a short term bounce from the ascending support trendline on the hourly chart, at the point of intersection between this line and the central pivot. This therefore forms the support for the day.

At $53.26, WTI crude oil is testing the R1 pivot resistance. A break of this level will open the door to the $53.65 and $54.34 near-term resistance areas. If price is resisted firmly at the R1 pivot, crude oil may fall back to retest the $52.57 area, right on the ascending support trendline. A downside break of this support trendline will lead to a test of $51.49 and $51.00.