The Nifty 50 started Thursday’s session on a quiet note, trading just above the 25,500 mark after a subdued handover from global markets. Meanwhile, the BSE Sensex edged up by 28 points, opening around 83,550 as investors turned their focus to earnings and trade headlines.

While the index is holding its ground, investors appear unwilling to chase prices just yet. The key driver now is corporate earnings, with several heavyweight reports expected to set the tone for the coming sessions.

India–US Trade Deal Delays Keep Market Sentiment in Check

Part of the hesitation in today’s open stems from delays in the much-anticipated India–US mini trade deal. With no formal announcement yet and the deadline pushed to August 1, traders are wary of building large positions ahead of clarity.

Global cues were also mixed, with Asian markets split and US tech stocks powering Wall Street higher overnight. Locally, sectors like metals, PSU banks, and consumer durables showed early strength, while IT and FMCG lagged.

Nifty 50 Technical Chart Levels: Key Resistance and Support Zones

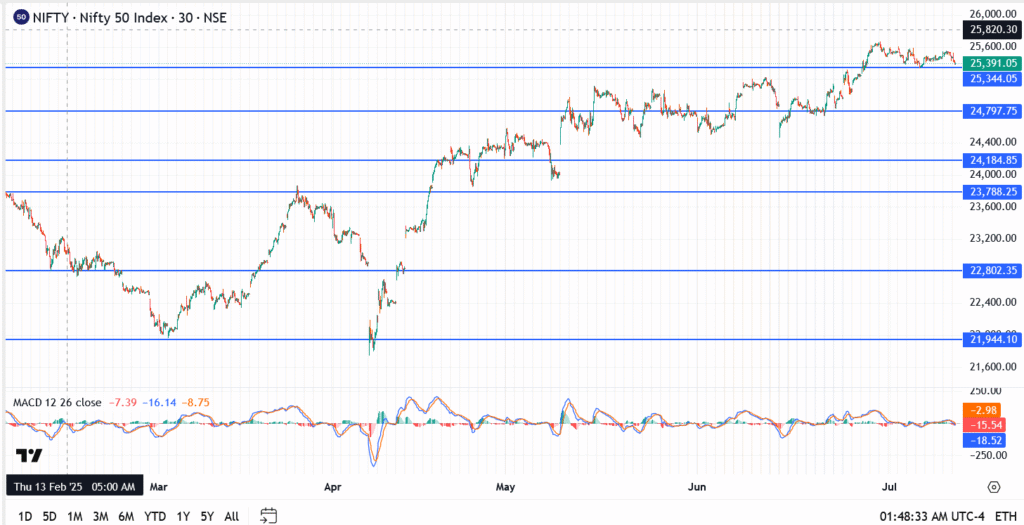

After a failed breakout earlier in the week, the Nifty 50 remains trapped in a narrow band, testing traders’ patience. According to market technicians, the 25,344 mark is a key level, and bulls need a convincing break above it to reignite momentum.

Key Nifty 50 Levels Today:

- Current Price: 25,391.05

- Immediate Resistance: 25,548

- Next Key Resistance: 25,670

- Initial Support Zone: 25,344

- Deeper Supports: 24,797.75, 24,184.85, 23,788.25

MACD: Neutral-to-slightly bearish, no strong crossover yet

Bias: Cautiously bullish, but still rangebound

Stock Market Outlook: Can Nifty Break the 25,548 Wall?

Markets are waiting for a spark. That could come from strong Q1 results, particularly from bellwethers like Tata Consultancy Services and Indian Renewable Energy Development Agency reporting today.

If bulls manage to reclaim 25,548, the door opens toward the June high at 25,670. On the downside, 25,344 remains crucial. A breach below it could invite a dip toward 24,800 in the short term.

The market isn’t bearish, just indecisive for now. Earnings, global cues, and tariff developments will dictate the next move.