The Indian market cooled on Tuesday as the Sensex slipped into the red, trading just above 80,600. Autos and pharma were the biggest drags, with names like Dr. Reddy’s and M&M under pressure. Still, gains in Reliance, NTPC, and select realty counters kept the index above the 80,000 mark, a level traders say is turning into the key battleground after last week’s volatile swings.

Market Drivers and Macro Tailwinds

The dip came even as domestic data painted a strong backdrop. India’s manufacturing PMI jumped to 59.3 in August, the fastest pace in nearly 18 years, pointing to resilient demand and robust output. Coupled with Q1 GDP growth of 7.8%, the numbers reaffirm India’s position as one of the world’s standout growth stories.

Flows, however, told a split narrative. Foreign investors pulled out ₹1,429 crore on Monday, while domestic institutions countered with ₹4,345 crore of fresh buying. It’s the same tug-of-war keeping the market in check, global caution on one side, local conviction on the other.

Buzzing Stocks on September 2

Dr. Reddy’s Laboratories: The pharma heavyweight slipped nearly 0.9%, extending pressure on the healthcare pack. Traders cited margin worries and global sector weakness as reasons behind the slide.

Mahindra & Mahindra (M&M): Shares eased 0.65% after recent gains, with auto counters struggling under concerns of slower demand momentum heading into the festive season.

Reliance Industries (RIL): Shares jumped 2.2% to an intraday high of ₹1,384.50 after Morgan Stanley highlighted RIL as a key beneficiary of China’s energy rationalisation. Analysts believe its integrated solar supply chain could cut energy costs by 40% by 2030, boosting new-energy earnings.

Maruti Suzuki: Lost 0.47% as investors booked profits, keeping pressure on large-cap autos. Analysts flagged rising input costs as another headwind.

Asian Paints: Fell 0.46% with consumer stocks showing fatigue. The stock has struggled to break higher in recent weeks, weighed down by cautious discretionary spending trends.

Ashok Leyland: The stock climbed 4% after announcing a partnership with CALB (HK) Co. Ltd to develop next-gen batteries. The automaker also reported a 5% year-on-year sales rise in August, further boosting investor confidence.

ICICI Bank: Dipped 0.33%, contributing to the drag in financials. While the weakness was modest, it underscored the broader rotation out of banks and into defensives.

Indraprastha Gas (IGL): Rose more than 3% after signing a joint venture with Rajasthan’s RVUNL to build a solar plant. For investors, it marks another step in IGL’s pivot toward clean energy, a theme still drawing institutional flows.

Mobikwik: Shares surged over 15% after the Abu Dhabi Investment Authority exited its 2.1% stake via block deals.

Sugar stocks: Dhampur, Renuka, Balrampur Chini, and Triveni gained sharply after the government allowed unrestricted ethanol production for 2025–26, sparking heavy sector-wide buying.

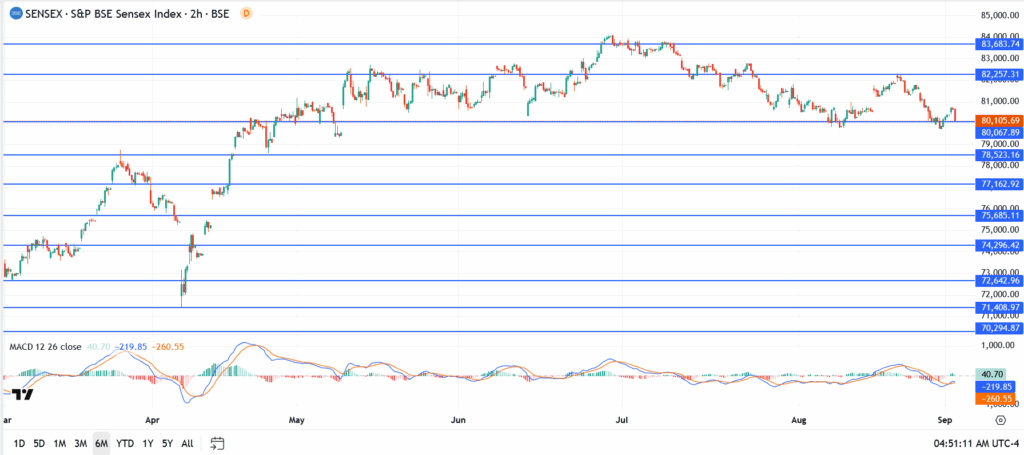

Sensex Chart Levels

- Support: 80,000 remains the critical short-term base. A break below could expose 78,523 and 77,162.

- Resistance: Upside hurdles are seen at 82,257 and 83,683.

Outlook

The Sensex’s pullback underlines how foreign selling and global caution are still capping momentum. Yet bulls continue to defend the 80,000 line, giving the index a base to build on. The question now is whether domestic flows are strong enough to fuel a move toward 82,000–83,600, or if September begins with deeper consolidation.

The index slipped into the red as selling in autos and pharma dragged sentiment. Still, bulls are holding the 80,000 mark, a line traders say separates consolidation from a deeper correction.

For most investors, yes. The index is built on India’s 30 biggest companies, firms that have survived cycles and grown alongside the economy. It won’t move in a straight line, but history shows the Sensex has beaten inflation and delivered wealth for those who stay patient

It’s the Bombay Stock Exchange’s flagship index, a basket of 30 heavyweight names from banking to energy and IT. Think of it as India Inc.’s scoreboard, when the Sensex is up, it usually means the country’s corporate health and growth outlook are firing.