Indian equities surged on Friday morning as benchmark indices climbed to fresh highs, supported by heavy buying in financials and industrials. The Nifty 50 breached the 25,000 mark, while the Sensex jumped more than 700 points to trade near 82,072 at last check.

The rally comes even as global signals stay mixed. U.S. markets were closed Thursday for Juneteenth, but futures slipped slightly in early Asian trade. Oil prices remain volatile amid simmering tensions between Iran and Israel, with traders watching closely for any sign of escalation or a diplomatic breakthrough.

Market Snapshot (as of 10:30 AM IST)

Weak pockets: Small caps and mid caps underperformed despite index rally

Nifty 50: 25,041.10, up 0.83%

BSE Sensex: 82,072.02, up 711 points (+0.87%)

Top Sectors: Financials, Auto, PSU Banks

Nifty Still in Range as Midcaps Face Valuation Pressure

VK Vijayakumar, Chief Investment Strategist at Geojit, noted that the Nifty is still trading within a familiar consolidation band between 24,500–25,000. While today’s breakout is positive, he warned that only a resolution to the Middle East conflict or a clear drop in crude might take the index materially higher. On the downside, institutional buying is expected to protect the lower end of the range.

The pressure remains on mid and small caps, which continue to see valuation-driven selling, Funds may rotate into safer large-cap names in autos, real estate, and industrials.”

Said Mr. VK Vijayakumar

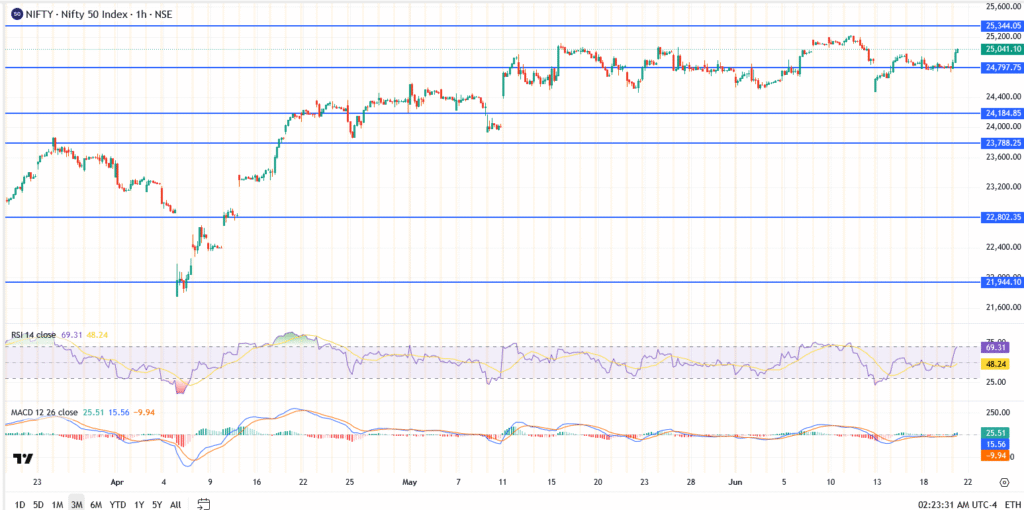

Nifty 50 Index Chart Analysis Today

- Current price: 25,041.10

- Immediate resistance: 25,344

- Support levels: 24,797, then 24,185

- Structure: Strong upward momentum after holding above 24,800; needs confirmation above 25,344 for trend extension

BSE Sensex Chart Analysis Today

- Current price: 82,072.02

- Resistance ahead: 82,757, then 83,683

- Support to watch: 80,067

- Structure: Price has cleared a week-long range; next test comes near 83,000 zone

Conclusion

The bulls are clearly in charge this Friday, but traders remain cautious about the external environment. If oil prices stay contained and no fresh Middle East shocks emerge, the path higher remains intact, especially for large caps riding domestic policy tailwinds. However, caution is advised in overvalued SMIDs, where profit-taking is likely to persist.

For now, eyes are on 25,344 for Nifty and 83,683 for Sensex as next resistance markers.