The Indian stock market weathered a volatile week, but bulls are far from defeated. Both the Nifty 50 and Sensex trimmed earlier gains by midweek, only to find support at critical levels as Friday trading gets underway. This weekly close now carries weight, not just for short-term momentum, but for how investors recalibrate ahead of the second half of June.

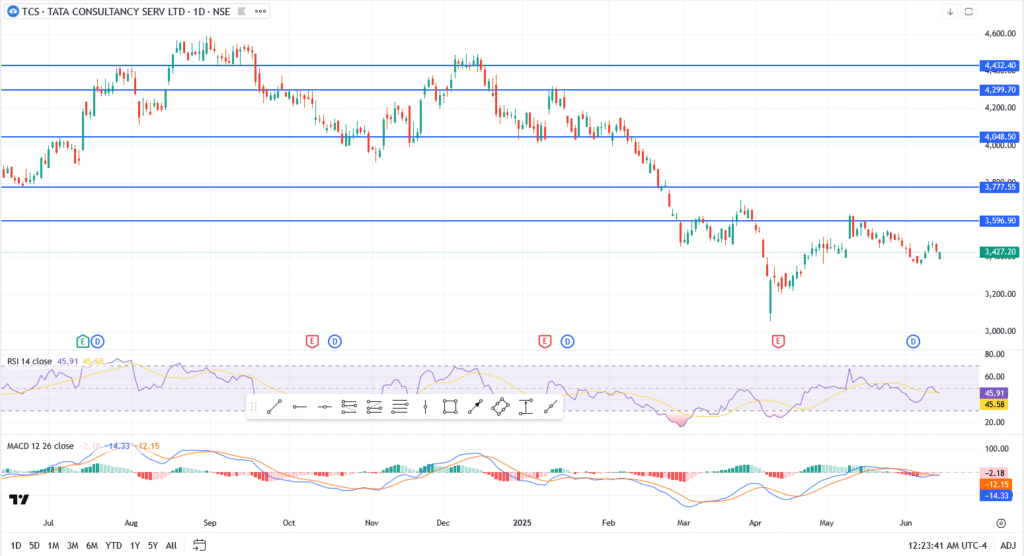

Nifty 50 Eyes Breakout but Faces Resistance at 24,800

The Nifty 50 opened the week on strong footing, pushing toward the 24,800 resistance zone. But by Thursday, price action began to soften, reflecting a mix of global cues and institutional repositioning. Even so, Nifty managed to hold above the 24,600 mark, a level that continues to act as the line in the sand.

Nifty 50 Chart Analysis Today

- Support remains firm at 24,184, the weekly low, with dip buyers stepping in every time the index slips below 24,500

- If 24,800 breaks convincingly, the next leg could extend toward 25,344, the last major swing high before the April correction

- Below 24,184, bears may regain control with eyes on 23,788, which would mark a trend violation

From a technical standpoint, the RSI is hovering near 48.32, not in oversold territory but trending flat, hinting at indecision. The MACD shows a minor bearish crossover, though momentum hasn’t fully rolled over yet, suggesting a pause, not panic.

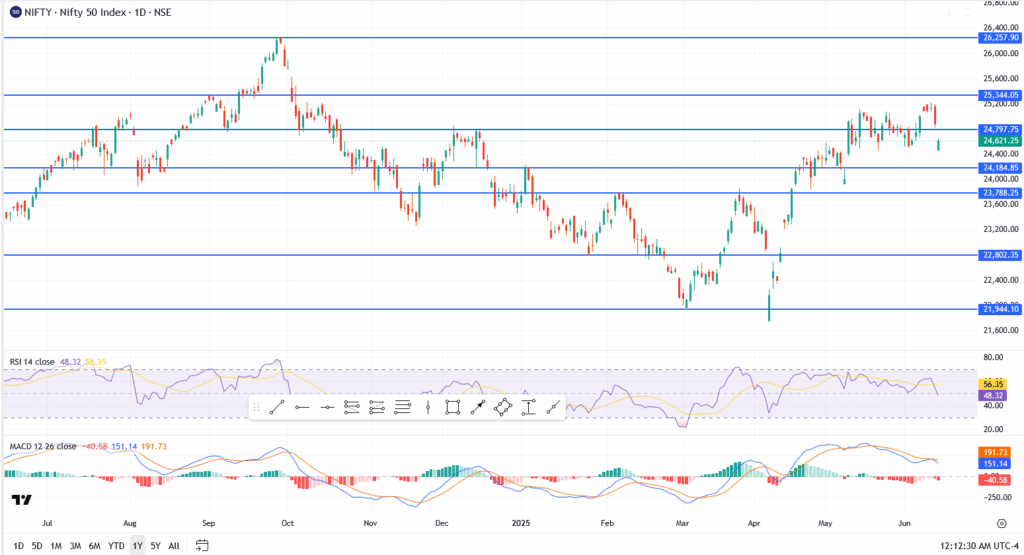

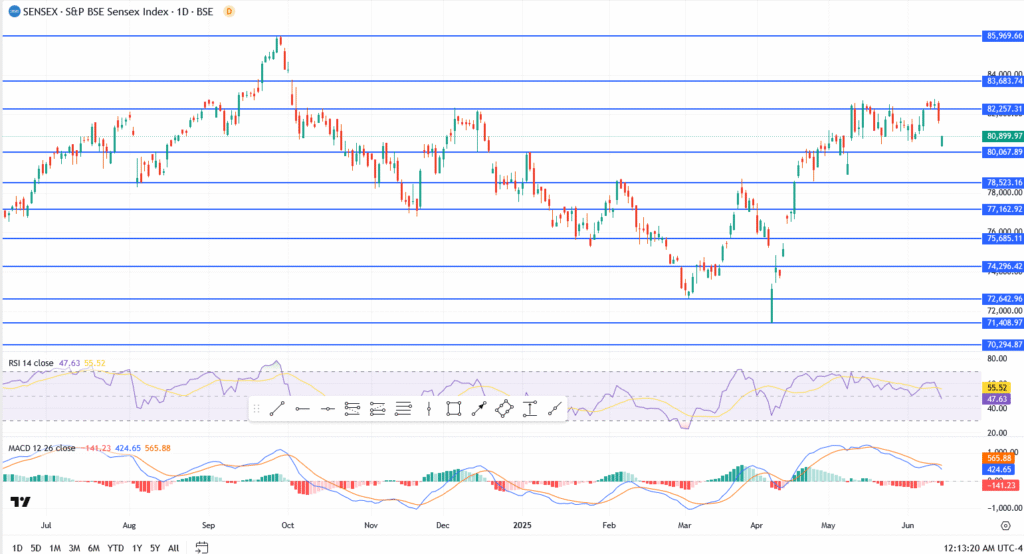

Sensex Still Holding 81K, But Bulls Need a Strong Friday

The Sensex followed a similar path. After testing 82,257 early in the week, the index pulled back, but managed to stay perched above 80,899, which has emerged as a critical near-term base.

The week’s structure shows:

- Sensex bulls are defending 80,067, the deeper support that marks the top of April’s breakout

- Any close above 80,899 today could fuel a fresh move toward 82,257, and later 83,683

- Conversely, a close below 80,067 opens the door to deeper losses, with 78,523 next on the radar

The RSI on the daily chart is at 47.63, just under neutral, while MACD remains bearish, a signal that while momentum is weak, there’s still room for upside if today’s session ends strong.

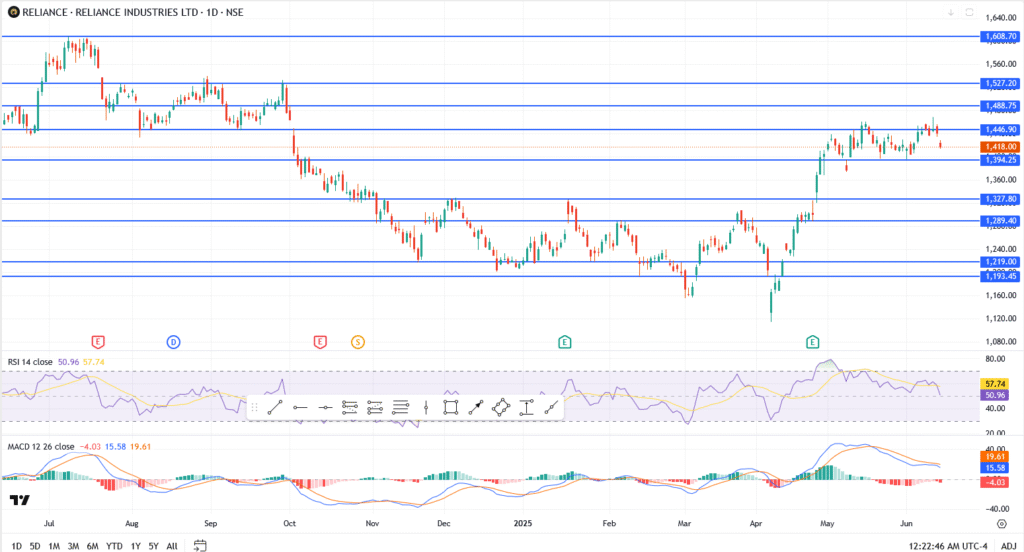

Reliance and TCS: Calm Amid the Volatility

Reliance Industries, often the bellwether for Nifty, held above its 50-day EMA this week, despite facing headwinds from global energy prices. The stock’s ability to hold ground stabilised the broader index. TCS also mirrored the market, after testing highs earlier this month, it slipped, but hasn’t broken its rising trendline.

Both stocks are acting as pressure valves: not rallying, but not breaking down either. If either begins to show strength next week, it could become the spark Nifty needs to break through the 24,800 ceiling.

Conclusion: Watch Today’s Close

This Friday close may not be flashy, but it matters. If Nifty holds 24,600 and Sensex stays above 80,899, bulls remain in the game. Breaks below support will shift the tone toward cautious consolidation. But for now, the charts are still tilted in favour of resilience, not retreat.