- Markets whisper of a breakout, but one hidden risk could flip the Nifty story overnight.

Macro Backdrop: Comfort Meets Caution

India entered this week with a rare duality. On one hand, the September retail inflation print collapsed to 1.54%, an eight-year low. That is not just a number—it reshapes the policy debate. The RBI, long cautious in its tone, suddenly has more room to think about easing without fear of stoking price pressures. For households and corporates, this is oxygen: cheaper borrowing costs and a stronger consumption pulse.

On the other hand, the world refuses to cooperate. The U.S.–China tariff back-and-forth continues to whipsaw risk sentiment. Washington’s threats of additional duties followed by a partial retreat left global markets dizzy. For India, the direct trade exposure is limited, but the psychological effect is not. Foreign portfolio investors don’t differentiate much between Mumbai and Manila when risk appetite sours.

Meanwhile, the Middle East remains a wildcard, with oil prices bouncing to every headline. For a nation that imports the bulk of its crude, even the hint of escalation translates into fiscal and corporate margin risks. This is why the local market, despite good domestic news, cannot entirely shake off global caution.

Market Behavior: Selective Strength, Fragile Breadth

The Nifty opened around 25,200, leaning on IT and pharma. HCLTech’s upbeat results reinforced confidence that India’s outsourcing machine is still humming, and the weak rupee sweetened the earnings outlook. Healthcare too saw steady bids, underpinned by export orders and government support.

But the glow was not universal. Banks and consumer names dragged, reflecting pre-earnings nerves. Analysts warn that more than 50 companies could face double-digit profit slumps this quarter, a sobering prospect that tempers optimism.

Flows tell the same story: foreign investors have been sellers, pushing the rupee to hover near 88.7 per dollar. Domestic institutions have picked up part of the slack, but the tug of war between outflows and local resilience keeps volatility high.

And then there’s the index reshuffle: Max Healthcare and InterGlobe Aviation are set to join the Nifty 50, while IndusInd Bank and Hero MotoCorp step out. Passive funds will rebalance automatically, giving short-term momentum to the entrants. More importantly, it signals how the benchmark itself is evolving—healthcare and aviation are no longer side stories; they’re central to India’s equity narrative.

Technical Picture: Testing Resistance, Guarding Support

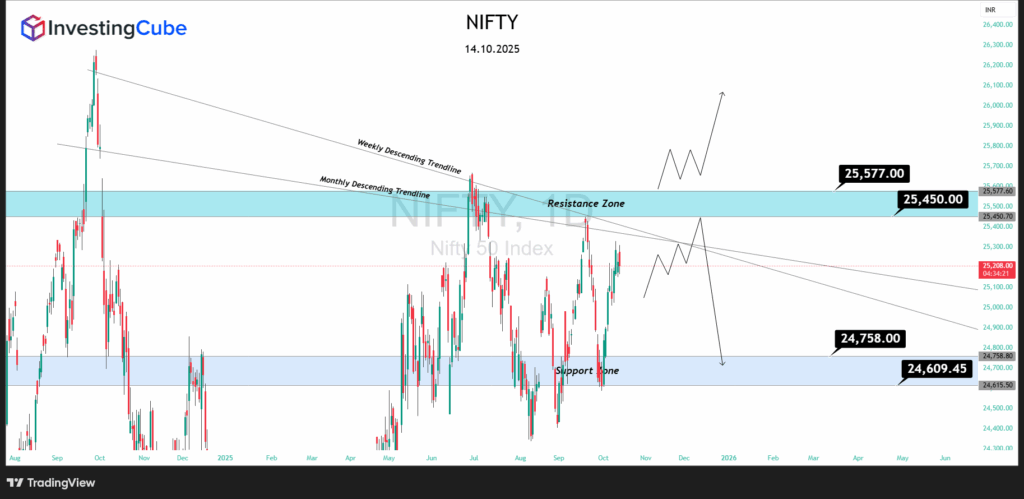

The chart captures the battlefield perfectly. The Nifty is pressing into a resistance belt between 25,450 and 25,580, reinforced by both the weekly and monthly descending trendlines. This is not a level to take lightly: each rally attempt over the past months has stalled in this very zone.

Below, the support zone at 24,600–24,800 is the floor that matters. A decisive break there would hand the bears control, likely dragging the index toward 24,300.

In between, price is coiling. If buyers can punch through resistance with conviction, the path opens toward 25,800 and eventually 26,000. Fail, and we are likely to see another rejection, forcing a retreat back to the lower band. In short: the market is cornered, waiting for a catalyst.

Outlook: Balancing Conviction with Caution

Three drivers will dictate which way the stalemate breaks:

- Earnings season delivery. If IT and select heavyweights beat expectations, Nifty could finally pierce the ceiling. But disappointment risks amplifying the resistance zone’s grip.

- Global risk temperature. Trade rhetoric, oil volatility, and U.S. data will shape foreign flows. India can’t detach itself from the global tide.

- Policy stance. Inflation’s sharp fall gives the RBI space. Even a hint of dovishness could flip sentiment and provide the breakout fuel.

For now, the tactical call is selective participation. IT and pharma retain structural momentum. Banks and consumer names warrant patience until the earnings fog clears. Traders may consider accumulating near support, but only with disciplined stop-losses. The next 2–3 weeks could define whether 2025 ends with Nifty challenging fresh highs—or stuck in another sideways grind.

Because it coincides with both horizontal resistance and descending trendlines, making it a confluence level that historically rejects rallies.

They boost confidence that the RBI can ease without risking instability, raising expectations of liquidity support and better valuations.

It signals shifting priorities in the Indian growth story. Healthcare and aviation’s entry highlights where structural demand is building.