- The Nifty 50 Index has had multiple ups and downs in the third quarter of the year, but much could change as the fourth quarter approaches.

The Nifty 50 Index comprises companies from many different industries, such as IT, oil and gas, consumer products, and vehicles. It makes up more than 60% of the NSE’s free-float market valuation. The index is at 24,821 as of this writing, having risen by 0.4% in the last month. This shows that it has experienced relative volatility, reflecting domestic and global economic struggles.

Q3 2025 Performance: Headwinds and Volatility

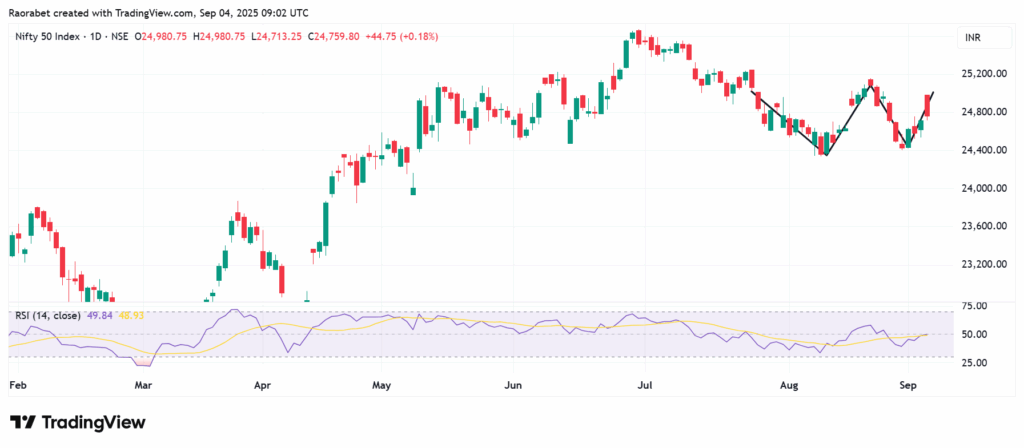

The Nifty 50 Index (INDEXNSE: NIFTY_50)closed at 25,517.05 on June 30, 2025, which set the baseline for the quarter. Q3 2025 started off quite stable. The index started July with a small rise, achieving a monthly high closing of 25,541.80 on July 1. But as the quarter went on, momentum slowed down because of challenges in the global bond market, mounting U.S. budget concerns, and concerns over tariffs. The index had dropped to 24,768.35 by July 31, which was a 3% drop from the start of the quarter.

During the quarter, sales growth slowed for many Nifty 50 companies, and the overall topline growth hit a 16-quarter low. Fluctuations became more frequent in August. On August 8, the index hit its quarterly bottom with a close of 24,363.30, and on August 21, it reached a high of 25,153.65. Foreign institutional investor (FII) outflows exacerbated this volatility.

The most important thing that happened this quarter was that overall Profit After Tax (PAT) increase went up to 9.5% YoY, the highest level in three quarters. The financial services sector was the main driver of this spike, accounting for a huge 70% of the Nifty 50’s YoY profit growth.

The slow growth in sales implies that demand across the economy hasn’t entirely caught up with the recovery in profits. As a result, the strength of the quarter was mostly in margins, not in the growth of the top line.

The Nifty 50 Index has formed a double-bottom pattern on the daily chart. Source: Tradingview

Nifty 50 Q4 Outlook

Analysts project that Q4 will be a time for consolidation and picking stocks carefully. Those looking to invest should prioritize companies that have solid foundations and a visible path to growth. Some of the positive developments expected include Goods and Services Tax (GST) cuts to boost spending, healthy balance sheets, and backing from the RBI for policies.

Earnings may still be sluggish from Q3, but a 6.4% increase in net income for Nifty corporations in FY25 shows that they are strong. The success or failure of policy and macro factors in maintaining momentum, as well as the ability of results to surprise to the upside, will thus determine what happens in Q4.

There are still risks, such as ongoing FII outflows and geopolitical tension between countries. Global events, such tensions between countries and the likelihood of more US tariffs, could also hurt the market. However, inflows from both retail and domestic institutional investors (DIIs) are projected to keep supporting the market. This is an important counterbalance to any selling pressure from foreign institutional investors (FIIs).

The country’s GDP growth remains resilient, providing a strong backdrop for corporate earnings. Government initiatives, particularly continued capex spending and potential policy reforms like a GST rate cut, are expected to provide a tailwind for the market.

In Summary

On the one hand, India’s macroeconomic fundamentals are still rather robust. For example, revisions to the goods and services tax are expected to make things more efficient, and a stable fiscal framework gives investors confidence. On the other hand, the Nifty 50 Index trades at more than 23 times anticipated earnings, making it one of the most expensive in the world.

That doesn’t leave much space for disappointment, especially because earnings growth has been mired in the single digits for five quarters in a row. The international investor community has also become more cautious of Indian equities after buying a lot of stock early this year. If flows continue to go the other way, the market could continue being under for much of the fourth quarter.

The Nifty 50 Index has primarily been driven by strong financials, although revenue remained weak and valuations have largely overstretched.

The fourth quarter of the year will likely be hinged on earnings, government policies and foreign institutional investor (FII) inflows/outflows.

Potential risks include weak earnings, high FII outflows and elevated geopolitical pressures, including US-India relations