- HSI closed 26,363 points, with the 52-week high range.

- Baas case: Risks: U.S.Fed policy, China property weakness, and global growth uncertainties.

The Hang Seng Index ended at 26,363.14 points, after a gallant opening near 26,564.50. The intraday range was broad enough, with a low of 26,115.50 and a high of 26,617,50 during the day. The 52-week range of the HSI is between a low of 18,671.49 and a high of 27,381.84.

From a technical viewpoint, the RSI (14 day) is currently at 57.9 suggesting mild bullish momentum. The moving averages give mixed signals. The short-term is clear “sell” signals while the 50-day reflects a “buy” signal and the 200-day is still a “sell” signal. This, in effect suggests uncertainty in the short-term but underlying medium-term support.

Fundamental Drivers

Positive Factors

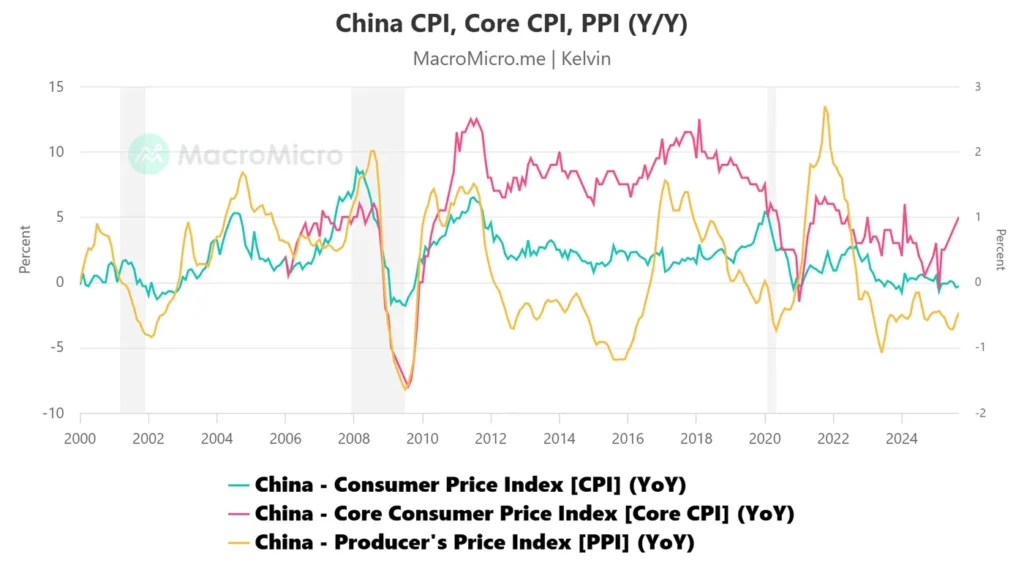

The HSI continues to benefit from begin macro backdrop in mainland China. According to MarketPulse, recent data show that deflationary pressures are easing, with China’s core CPI rising, while signs of stabilization in the housing sector, provide provides a positive base for investor sentiment.

Moreover, Beijing’s policy support is an important key driver, as there are indications that there will be further stimulus and injections of liquidity into the economic, as mentioned by FXEmpire.

Global conditions are also reasonably good, with liquidity plentiful benefits, combined with less aggressive stance from the Federal Reserve, which indirectly benefits such risk assets as Hong Kong equities. Analysts observed that the HSI’s medium term is still intact with recent strength, serving to reinforce the argument for continued upside.

Risks & Headwinds

Despite the positive outlook, a number of risk remain. First, the HSI is now near the top of it’s 52-week trading range in the area of 27,381 points which limits upside potential and raises the chance of profit taking. Also, externally, the Federal Reserve’s interest rate policy. US -China relations and uncertainties in global growth factors are major downside factors.

Domestically, Hong Kong, and mainland property sectors remain weak with still evident credit risks and uneven service recovery still evident, as noted by South China Morning Post. These latter factors could also moderate a bullish market response and or lead to volatility if negative data or headlines occur.

In short, the above analysis indicates that HSI is in a supported period but not without it’s difficulties, while the momentum is still positive. The market has probably absorbed much of the “easy gains” and is now gradually resuming a more cautious and range bound position in necessary trading.

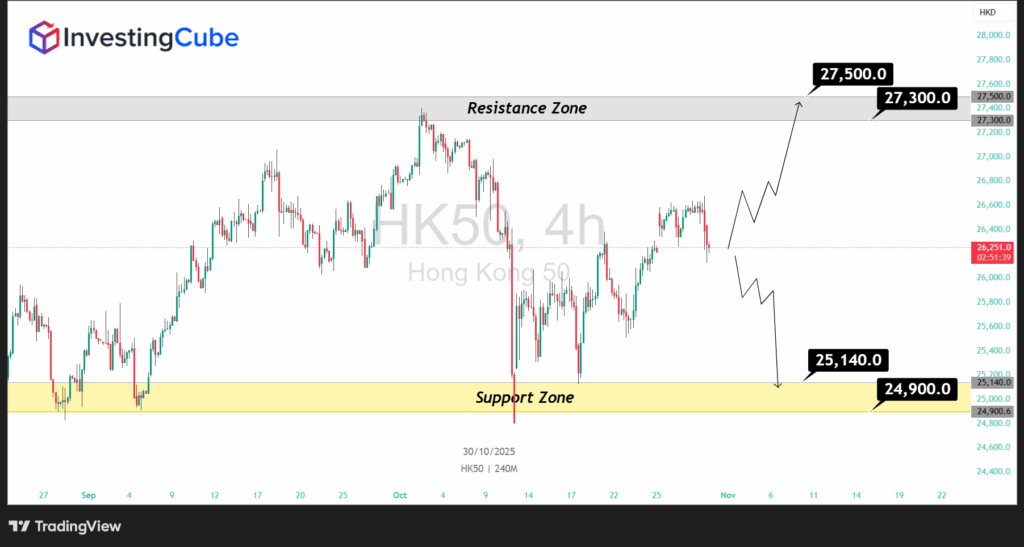

Hang Seng Index Price Forecast

- Support: 25,140 – 25,150 points ( strong historical support zone)

- Resistance: 27,300 – 27,500 points (upper bound of recent range)

Base Case (Most Likely)

The HSI is expected to trade within a 25,500 to 27,300 band, with a mild upward base. Supportive underlying factors such as policy easing an improving economic data suggest consolidation with a slight bullish bias.

Bullish Scenario

In the event that the index breaks above the previous 27,300 to 27,500 decisively on good volumes, this could trigger the next higher leg, which could get an index looking to head even beyond 27,500. This has the potential for a breakout to occur, but would more than likely need to be stimulated by a clear positive input, such as a stronger than expected policy stimulus or a surprise on the earnings side.

Bearish / Correction Scenario

If support around 25,140 fails, it may allow for momentum to drag the index down to either 24,000 to 25,000 points levels which is correctional pullback prior to any fresh rally attempt. External shocks weaker volume data in the property sector, or global wave of risk-off sentiment may do the trick.

Conclusion

The Hang Seng Index maintain its resilient posture supported by improving Chinese data as well as optimism over policies. However, with the index now, resting on the higher end of its yearly range, we feel the chances of consolidations are higher. Both homegrown signals from the property sepulcher, as well as the nature of global monetary conditions can prove to be key swing influencers. In the short run, the HSI price forecasts indicate that we will see trading in a sideway to fashion with little breakout potential unless a strong catalyst presents itself.

Frequently Asked Questions about Hang Seng

It may indicate the potential new bullish leg with targets above 27,500 if such a breakout indeed comes. However, such a breakout is unlikely to occur unless something strong provides the catalyst for it like a stronger policy stimulus or corporate earnings surprises.

The 25,150 level has repeatedly proven to be a key support area. If it fails on a subsequent test of support, it will likely trigger a technical selling, which will push it lower in the direction of the 24,000 to 25,000 area.

Here we have to go a little deeper into the fundamentals of what constitutes fundamentals or technicals. The fundamentals, i.e. the Chinese economic information, etc., as well as policy stimulus and global liquidity give the medium term direction However, the technicals such as support and resistance, RSI, moving averages, etc. give definition in the short term as to what the trading ranges are. Together, they provide the complete picture of what may be transpiring.