The Hang Seng Index predictions for 2026 hinge on the policy outlook and earnings delivery of listed companies. The Hang Seng Index (HSI) is Hong Kong’s stock exchange, and the available Hang Seng Index price predictions are mostly bullish. However, this is not expected to be a one-way push to the upside, as concerns about China’s growth outlook and occasional risk-off headlines could be headwinds for the HSI’s 2026 forecasts.

Live chart

Hang Seng Index Predictions 2026: Fundamental Drivers

The fundamental drivers for the Hang Seng Index predictions for 2026 are centered around the following:

- Chinese policy

- Earnings Delivery

- Tech/AI

- External Macros

- Property Sector Spillover

The bulk of the fundamental influence lies on Chinese policy, earnings delivery and tech/AI input.

1) China policy

The Hang Seng Index tends to move in tandem with Beijing’s fiscal and monetary stance. Stimulus headlines from the mainland impact the HSI’s price moves.

2) Earnings delivery

The HSI outlook from IG expects earnings growth for companies listed on the Hang Seng to improve, with a base case of 8% YoY growth. Whether these growth projections are met will determine the market’s response to the index’s stocks.

3) Tech/AI Input

Tech- and AI-led rerating of the index had a significant impact on the Hang Seng index’s 2025 performance. The 2025 AI-fueled rally is expected to spill into 2026 with a flurry of AI-related listings on the index, according to the Wall Street Journal’s outlook. The headwinds here stem from regulatory actions that could lead to narrow margins.

4) Property-market spillover

China’s property market has had a woeful experience in the last two years. The property market remains a key driver of Hang Seng Index predictions, as it affects risk perceptions, investor confidence, and China’s risk premium. Negative headlines could trigger risk-off induced selling.

5) External macros

Fed easing expectations create a cheaper US Dollar, which typically increases the attractiveness of emerging markets. Watch for any increases in portfolio funds to Asian markets and the expected bullish impact.

Hang Seng Index Predictions 2026

Several 2026 Hang Seng Index predictions are available. The key ones come from HSBC, Morgan Stanley, and IG.

HSBC Private Bank has a 2026 Hang Seng Index prediction target of 31,000, a bullish call with an implied upside of 15.89%. Morgan Stanley’s 2026 HSI price forecast reports a base-case target of 27,500 by the end of December 2026, which is not far removed from the current price.

IG used a market-outlook price forecast model to arrive at a Hang Seng Index prediction of 28,300 by end-2026, citing earnings growth assumptions as the primary price driver.

Technical Outlook

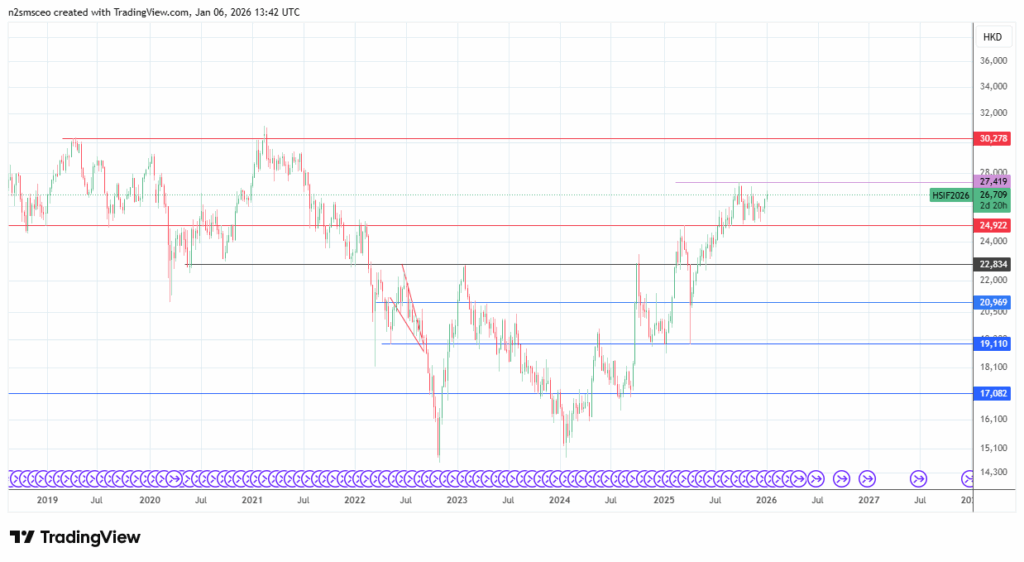

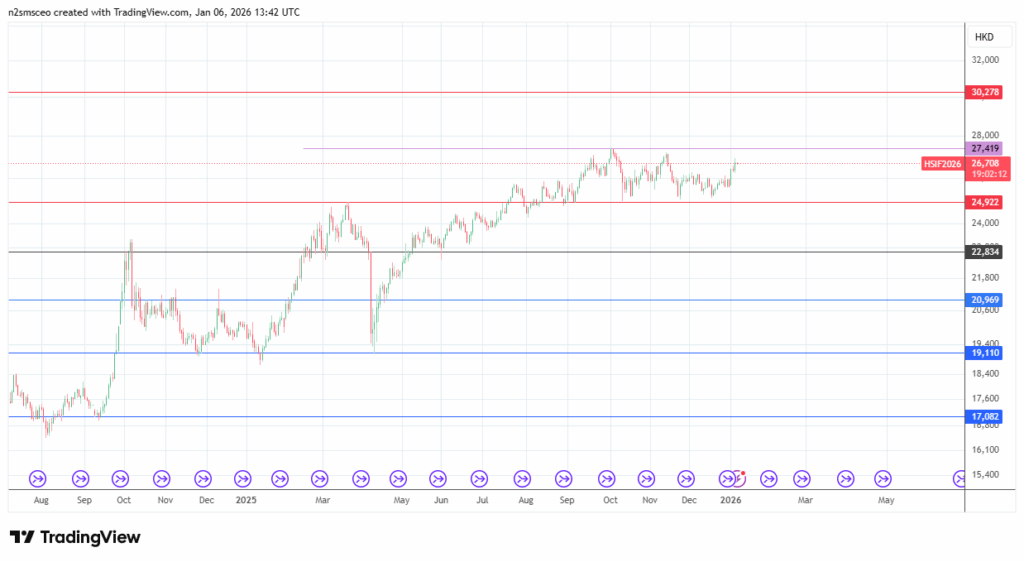

The daily chart shows that the price action is presently consolidating following a sequence of higher highs and higher lows stemming from the spring 2025 recovery. The range ceiling at 27419 must be uncapped for the breakout move to aim for the next available target at 30278, a significant supply zone formed by the 8 February 2021 high.

The range floor at 24922 keeps the primary trend intact. Loss of this support could trigger a significant pullback towards the 22834 support level. This new support is the line in the sand and must remain intact to prevent a further decline to major structural support levels at 20969 and 19110 (the November 20204 and April 2025 lows).

FAQ

What is the Hang Seng Index’s price today?

The Hang Seng Index futures are currently trading at 26808 as of writing on 6 January 2026.

What are the Hang Seng Index prediction targets for 2026?

The Hang Seng Index prediction outlook for 2026 is not one-way. Publicly quoted targets range from 27,500 to 31,000 by end-2026.