- Discover the latest news and performance insights on the Hang Seng index. Our technical outlook provides essential analysis for investors

The Hang Seng index is the main stock market index for Hong Kong. It tracks the daily performance of the largest and most liquid companies listed on the Hong Kong stock exchange, serving as a key indicator of the city’s economic health. Today, Chinese technology stocks are rallying and accelerating, with a new boom in artificial intelligence driving key indices, such as the Hang Seng, to their highest levels in nearly four years.

This article analyzes the Hang Seng’s performance and news, highlighting the key factors that drive it. It also covers the technical outlook for the index and finally addresses the most frequently asked questions.

Hang Seng News | What’s Driving Chinese Tech Stocks?

- The Hang Seng index jumps by 464.36 points or 1.76%. At the time of writing, the index is trading around 26,903.

- The Hang Seng surged and reached its highest point since November 2021.

- The major factor that drives the K50 index to rally is that major Wall Street banks have been raising their target prices for Chinese tech stocks.

- Many tech giants gain today, such as Baidu surges by 15.46%, JD.com gains by 3.24% and Alibaba gains 1.91%.

- Most of the Chinese tech stocks posted a significant increase in their share prices.

- The US-China easing of tension plays a vital role in making investors optimistic. Rising expectations that significant investment by technology companies in artificial intelligence will pay off.

- The Hang Seng outperformed its peer benchmark indices by 41% this year.

- The HK50 index is hitting a seventh consecutive weekly high.

- Investors are once again turning their attention to Chinese technology stocks.

- The forward P/E ratio for the Hang Seng index is 20.5 times. This is based on Bloomberg data. The ratio is below its five-year average of 23.3 times. It is also lower than the Nasdaq 100 index’s P/E ratio of 27 times.

- “Chinese tech companies are accelerating their spending on AI and are monetizing it faster than expected. With their valuations lower than in the U.S., investors are now turning their attention back to them.” Chief Investment Strategist at Saxo Bank said.

- Goldman Sachs raised its target price for Alibaba.

- Arete Research Services upgraded Baidu’s American Depositary Receipts. Rating changed from a sell to a buy. That’s in response to a growth potential in its self-developed chip business.

- JPMorgan upgraded CATL (a battery manufacturer). After this announcement, CATL’s shares surged.

- As Chinese technology giants are making significant investments in the artificial intelligence sector, the benchmark index Hang Seng rallies.

- Alibaba, Tencent, Baidu, and DJ.com are set to increase their capital expenditure. It’s projected to reach $32 billion by 2025, according to Bloomberg.

- This amount is more than double the $13 billion spent in 2023.

- Given all of these positive developments, Chinese stock will continue their rally.

Hang Seng Technical Outlook:

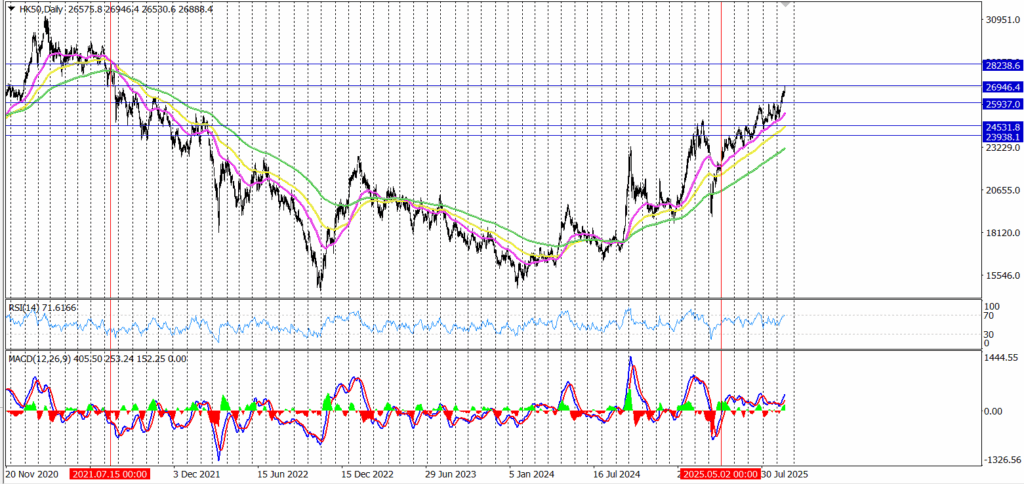

The Hang Seng has been consolidating above the 50-day, 100-day, and 200-day moving averages since May 2025 on the daily chart. The price action has been forming higher highs consecutively. These higher highs are 23,938, 24,531.8, 25,937.0, and today’s high at 26946. Each high is now acting as a support regardless of today’s high.

Today’s high is acting as a strong resistance. A clear day close above the 26946 level could pave the way toward 28238, which is the high of July 15, 2021. This level has never been tested since that time.

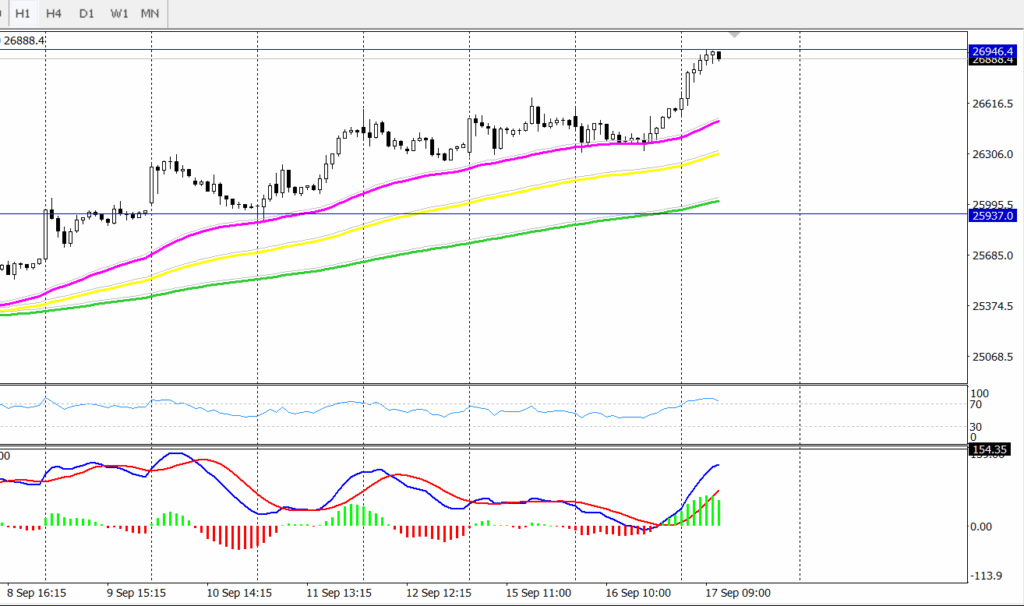

On the 1-hour chart, the MACD signals a bullish momentum, indicating that the bullish scenario remains intact. The RSI has turned from 78 to 70, which suggests that buyers may be losing some of their power due to profit-taking. This may cause a price correction, but the overall bullish trend remains in control.

The Hang Seng Index is a Hong Kong stock market index that tracks companies listed on the Hong Kong Stock Exchange; however, it includes both Hong Kong and mainland China companies.

The Hang Seng Index is a key indicator for Hong Kong’s market. It’s compiled and maintained by a company called Hang Seng Indexes Company Limited, which is a part of the Hang Seng Bank.

The Hang Seng Index comprises 82 constituent stocks. The index is market-capitalization weighted, which means that a stock with a higher market cap has a greater weighting in the index. The index tracks the daily changes of the largest stocks listed on the Hong Kong Stock Exchange and represents approximately 58% of the exchange’s total market capitalization.