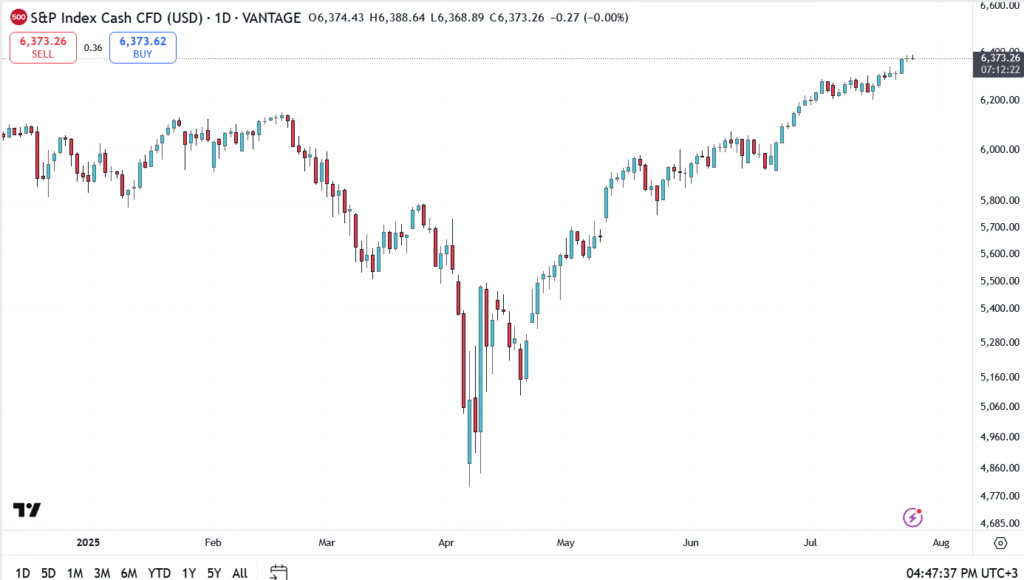

The S&P 500 has barely blinked this week, it just keeps climbing. With the index now coasting near its all-time highs at 6,373, investors are beginning to ask the question no one wanted to hear last month: how long can this last?

At face value, the setup looks perfect. Earnings have surprised to the upside, the soft landing narrative is intact, and capital keeps flowing into Big Tech. But underneath this strong exterior, cracks are quietly forming.

Is the S&P 500 Rally Sustainable?

The current market strength is real. More than 80% of companies reporting so far have topped EPS estimates. That’s not trivial. But unlike previous rallies that lifted the entire market, this one has been unusually narrow. Just a handful of mega-cap stocks, mostly AI-driven names like Nvidia, are carrying the weight.

That’s not inherently bearish, but it does raise red flags about fragility. If Nvidia or Microsoft stumble, the whole index could feel it. Traders are also watching speculative options volumes rise again, a classic late-stage bull signal.

What Smart Money Is Doing With the S&P 500 Right Now

Fund managers have stayed cautiously bullish, but they’ve been rotating into value sectors like energy and financials. This quiet sector churn typically precedes a volatility spike. So while the S&P 500 looks calm, portfolios under the hood are shifting.

Retail, meanwhile, is chasing. Meme stocks, micro-caps, and weekly calls are flashing again, reminiscent of January 2021. That rarely ends gently.

S&P 500 Price Prediction and Key Technical Levels

- Current price: 6,373

- Resistance: 6,390 then 6,420

- Support levels: 6,310 and 6,225

- Structure remains bullish but near parabolic

- RSI flirting with overbought territory

- Price still within rising wedge pattern, caution advised

The chart is showing a textbook rising wedge, often a precursor to short-term pullbacks. Momentum hasn’t broken yet, but there’s very little breathing room left.

Will the S&P 500 Crash or Keep Rising?

Markets don’t correct because of bad news, they correct when everyone thinks they can’t. That’s the zone we’re approaching now. The rally has been clean, earnings strong, and macro headwinds mostly priced in. But this pace is unsustainable without a catalyst.

If the index clears 6,390 cleanly, the bulls may squeeze out another leg toward 6,420. But if fatigue sets in and we see profit-taking under 6,310, a shakeout could follow.

The risk-reward ratio at these highs is no longer in the bulls’ favor, and that’s exactly why everyone’s still buying.

Also happening in global markets: Indian stocks like Persistent Systems and IEX delivered unexpected post-earnings reversals this week, Lilly’s latest coverage breaks down what sparked the selloffs.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.