- IDEX stock price is nearing a strong support level. We explain what to expect if the stock crashes below this support.

The IDEX stock price is approaching an important support level as the electric vehicle (EV) sell-off continues. Ideanomics shares are trading at $0.84, which is a few points above the important support level at $0.8295, where it has struggled to move below several times this year. In addition, the firm’s market value has retreated from over $2 billion to just $439 million.

EV stocks sell-off

It has been a difficult time for EV stocks. For example, the Tesla stock price is in the bear territory since it has fallen by more than 20% from its highest level this year. Other EV shares have been worse. For example, Nio shares have dropped by 70% from its all-time high. XPeng is off by 64% from its all-time high, while Canoo has fallen by over 80%.

Ideanomics has not been left behind in this sell-off. Investors are mostly worried about several factors. First, there are concerns about margins as the cost of doing business rises. Some companies like Tesla and Rivian have already hiked prices because of these costs. Therefore, there are worries that these companies will experience slow growth because of the rising costs. Already, EVs are more expensive than combustion engine vehicles.

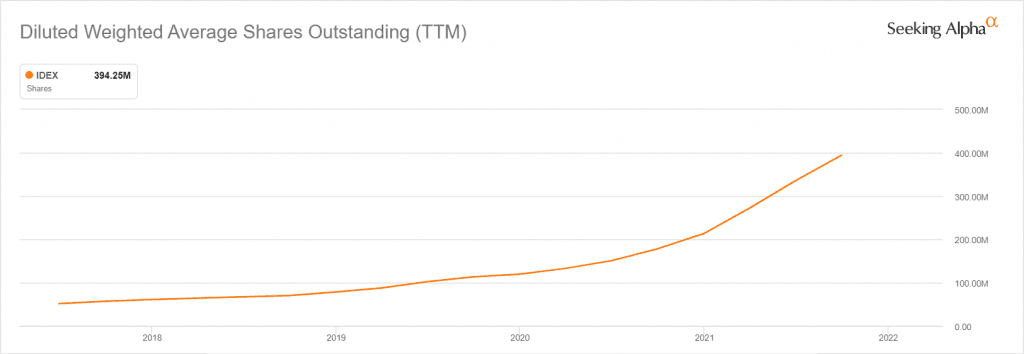

The IDEX stock price has also declined because of the rising concern that the company will need to raise capital in the near term. However, as shown below, the diluted outstanding shares have been in a strong upward trend for a while. This trend could continue now that the company needs cash to continue its investments. For example, it recently unveiled plans to unveil a giant experience and manufacturing facility in New Jersey.

IDEX stock price forecast

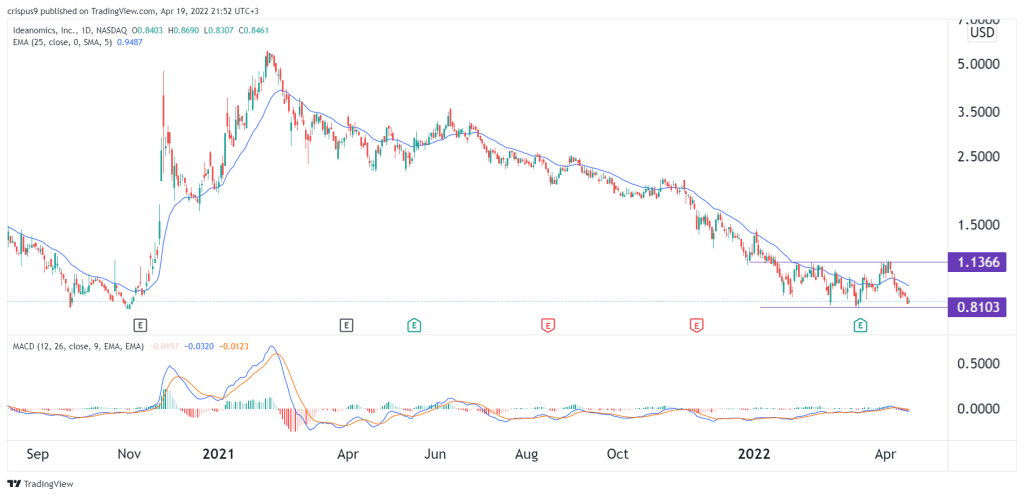

We see that the IDEX stock price has been in a major sell-off in the past few months on the daily chart. The shares are trading slightly above the important support level at $0.8100. It has failed to move below this point several times this year. It is also slightly below the 25-day and 50-day moving averages.

Therefore, the outlook of the Ideanomics share price is neutral. A drop below this support will signal that bears have prevailed, which will lead to more sell-off. On the other hand, a jump above the resistance at $1.13 will invalidate the bearish view.