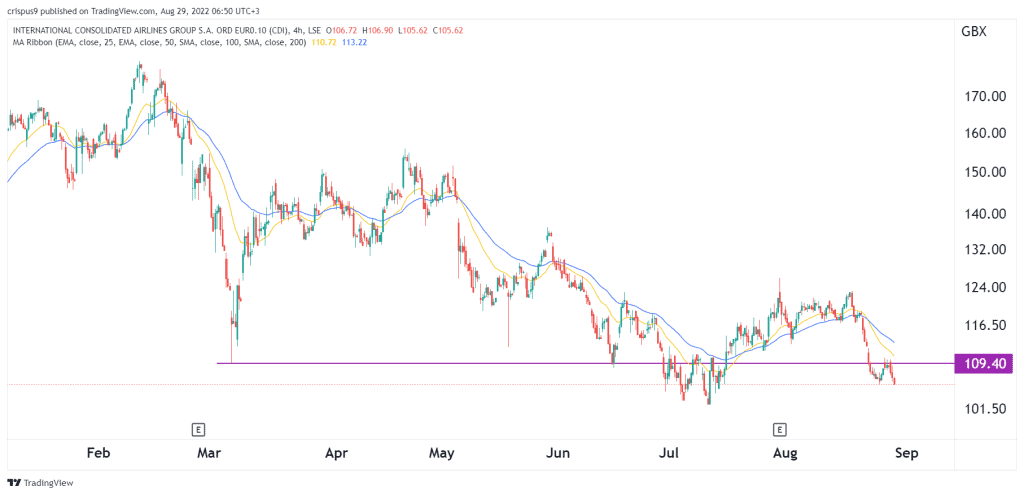

IAG share price continued its sell-off as woes in the aviation industry continued. Shares of International Consolidated Airlines Group dropped to a low of 105.62p, which was the lowest level since July 14. It has dropped by about 17% from its highest point in August and is about 425 below the highest point this year, giving it a market cap of over 5.2 billion pounds.

Aviation industry woes continue

The aviation industry is going through its toughest challenge in decades. While demand is still at an elevated level, companies are finding it difficult to accommodate those passengers. These challenges are because of the Covid-19 pandemic that led pushed airlines to park their planes and furlough their staff.

IAG’s brands like British Airways, Iberia, and Aer Lingus have seen a sharp increase in flight cancellations during the red hot summer season. Sadly, the company’s woes seem to be accelerating after the firm warned that it will likely cancel over 10,000 flights in winter. As a result, the company’s revenue growth is set to decelerate this year.

In July, IAG results showed that its total passenger revenue jumped from 1.14 billion euros to 7.64 billion euros in the first half of the year. Its total loss after tax narrowed to 654 million euros from the previous 2.04 billion.

So, is IAG a good investment? The British Airways parent company has gone through a difficult period in the past few months. And analysts expect that the business will continue going through substantial challenges in the coming months. This trend will likely see the IAG share price continue struggling.

However, in the long term, there is a likelihood that the business will recover as it solves its internal issues and as the cost of jet fuel pulls back.

IAG share price forecast

The four-hour chart shows that the IAG stock price has been in a strong bearish trend in the past few weeks. The recent sell-off was triggered after the shares formed a double-top pattern at around 125p. It has now dropped below the 25-day and 50-day moving averages and the important support at 109.40p.

Therefore, the stock will likely continue falling as sellers attempt to move below 100p. A move above the resistance at 109.40p will invalidate the bearish view.