- The Hang Seng index dropped to the lowest level in eleven months as contagion risks rose. The index declined by more than 3.3%

The Hang Seng index dropped to the lowest level in eleven months as contagion risks rose. The index declined by more than 3.3%, as casino and real estate groups sank. It has fallen by more than 20% from its highest level this year meaning that it is in a bear territory.

Evergrande share price sinks

The biggest catalyst for the sell-off in the Hang Seng index is the performance of the Evergrande share price. Shares of the second-biggest property group in China declined by more than 15%, bringing the year-to-date losses to more than 85%. This makes it one of the worst-performing stocks in Hong Kong. The Hang Seng, on the other hand, is the worst-performing indices in the world.

Investors worry that the collapse of Evergrande will have contagion risks in Hong Kong and China. If it is not bailed out and if the company fails to restructure its finances more sectors will be hurt. For example, there is a risk that highly leveraged property groups like Country Garden could struggle. Also, there is a risk that banks will be wary about extending finances to property developers.

The Hang Seng worst performers today were Henderson Land, Country Garden, New World, and CK Asset. Other companies exposed to the property market that declined are China Merchants Bank, Ping An Insurance, and AIA Group.

Hang Seng forecast

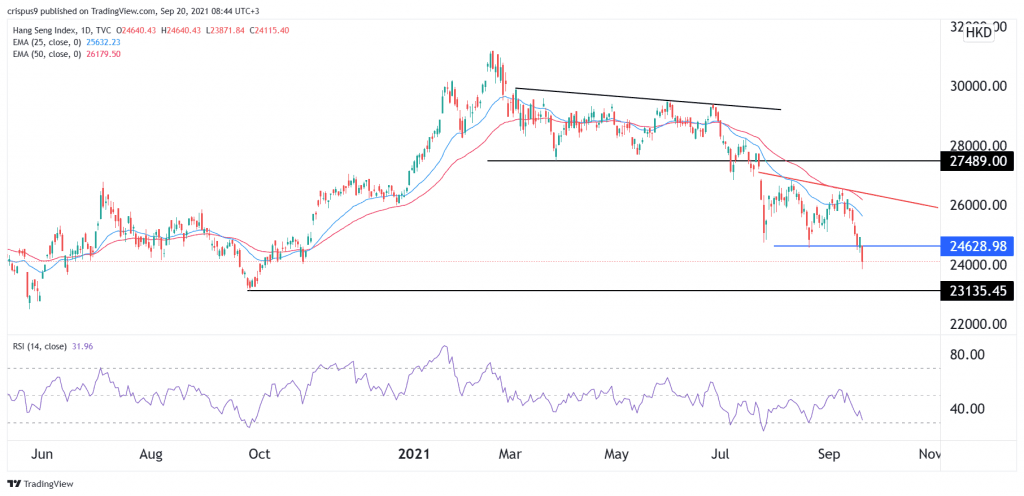

The daily chart shows that the Hang Seng index has been on a strong bearish trend in the past few days. The index declined below h$24,628, which was the lowest level since August 20th. This level was also the neckline of the descending double-top pattern.

It also moved below the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has fallen. Therefore, the sell-off of the index will likely continue as bears target the next key support at h$23,135. On the flip side, a move above $25,000 will invalidate the bearish view.