- The Hang Seng index crashed by more than 1.40% and reached a low of h$20,820. What next for the index as Hong Kong shares crash?

Hong Kong shares slumped hard for the second straight day as inflation concerns continued. The Hang Seng index crashed by more than 1.40% and reached a low of h$20,820, which was the lowest point since June 16th. Other Chinese indices like the Shanghai and China A50 also tumbled.

Why is the HSI index falling?

The Hang Seng index crashed hard for the second straight day as investors reacted to the strong jobs numbers published in the United States on Friday. The data showed that the country’s unemployment rate remained unchanged at 3. 6% in June of this year as the economy added over 372k jobs.

While these numbers were good, they also implied that the Federal Reserve will continue hiking interest rates in the coming months. The baseline is that the Fed will hike by 0.75% in July followed by 0.50% in September. As such, the inflation data scheduled for Wednesday this week will likely not have an impact on the Fed.

The actions of the Fed are important for Hong Kong shares because of the HKD peg. Hong Kong’s “central bank” usually follows the actions of the Fed. As such, it has already hiked interest rates by 150 basis points this year.

The Hang Seng index is also falling as investors react to China’s tech regulations. On Monday, the government unveiled new fines against Alibaba and Tencent for disclosure violations. This means that authorities are still fighting these tech giants.

Most companies in the HSI index were in the red on Tuesday. The worst performer was BYD, whose shares collapsed by more than 10.63%. It was followed by Country Garden, Alibaba, Alibaba Health Information, WuXi Biologics, and Orient Overseas. On the other hand, the top performers in the Hang Seng were ANTA Sports, MTR, Power Assets, and CK Infrastructure.

Hang Seng index forecast

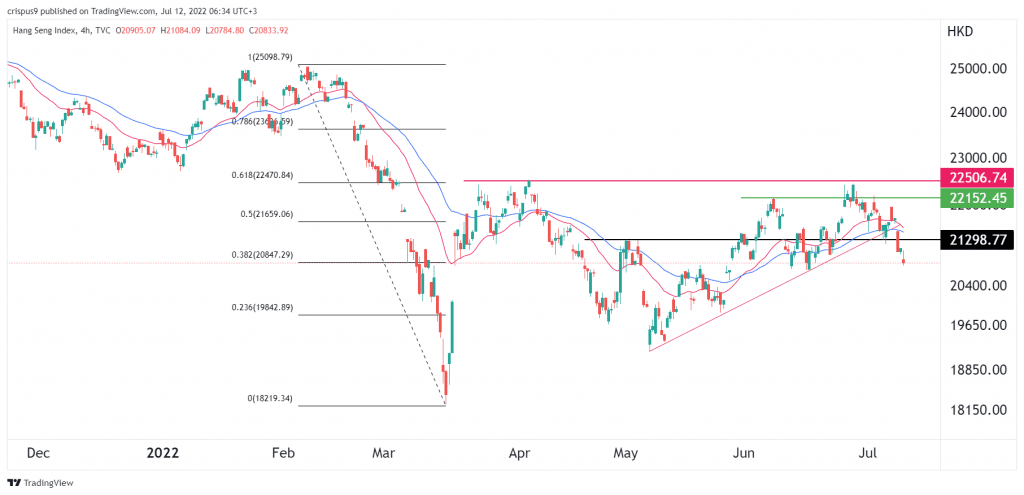

The four-hour chart shows that the HSI index rose to a high of h$22,505 in June as it attempted to recover. Since then, the index has made a strong pullback and is now trading at h$20,820, which was the lowest point on June 17th. The Hang Seng has managed to move to the 38.2% Fibonacci Retracement level. It has also crossed the important support level at h$21,298, which was the highest point on April 4th.

The index has also moved below the 25-day and 50-day moving averages. Therefore, the outlook for the Hang Seng index is extremely bearish, with the next key support being at h$20,000. A move above the resistance at h$21,298 will invalidate the bearish view.

HK50 S&R levels

The bearish view is supported by our S&R indicator. As shown below, the live indicator estimates that the Hang Seng index has a bearish view. It will continue dropping to about h$20,886 followed by h$20,795. On the other hand, the stop-loss for this trade is at h$21,182.