- The Hang Seng index popped by over 2% in early trading as global investors went bargain hunting in Hong Kong.

The Hang Seng index popped by over 2% in early trading as global investors went bargain hunting in Hong Kong. The index is trading at H$24,240, which is about 7% above its lowest level this year. It is still about 20% below its 2021 high.

The Hang Seng index had a mediocre year in 2021 even as leading indices like the S&P 500 and the Nasdaq 100 rose by over 20%. The weak performance was mostly because of Beijing’s crackdown on key industries like gambling, real estate, and technology.

Indeed, companies in these sectors were among the worst performers in the HSI index in 2021. They included Meituan, Alibaba, Galaxy Digital, and Tencent.

This year, a reversal has happened as investors buy the cheap Hong Kong equities. The Hang Seng index has risen by over 7%, making it a better performer than Nasdaq 100 and S&P 500. This performance is mostly because the index is cheap. For example, it has a price-to-earnings ratio of about 9, while the S&P 500 has a ratio of 27.

Hang Seng index forecast

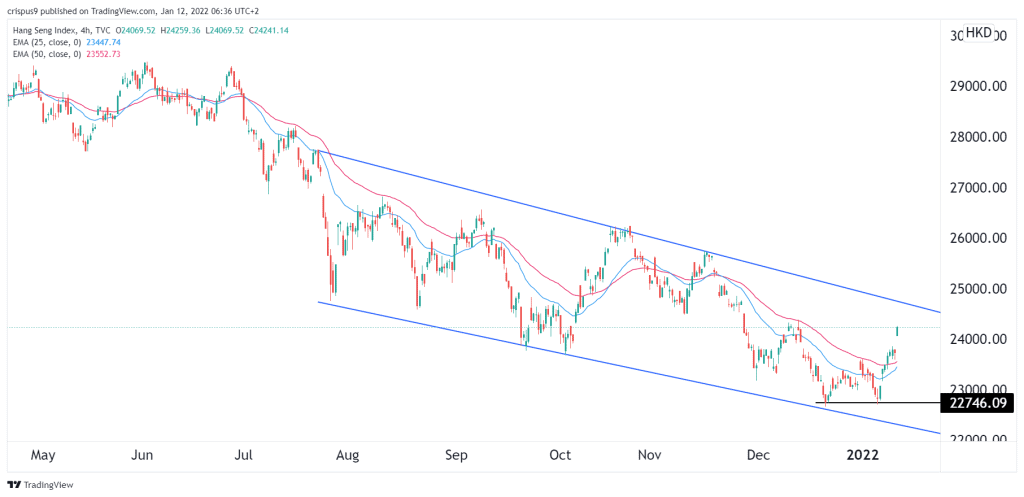

The four-hour chart shows that the HSI index has been in a strong bullish trend in the past few weeks. This trend started after the index formed a double-bottom at about 22,746. In technical analysis, a double-bottom pattern is usually a bullish signal.

The Hang Seng index has moved slightly above the 25-day and 50-day moving averages. It is also approaching the upper side of the falling channel that is shown in blue. Therefore, there is a likelihood that the index will keep rising as bulls target the key resistance at 25,000.