Halma Plc (LSE: HLMA) is a UK-based holding company involved in the manufacturing of safety-related products. Its operations are categorized into four major segments:

- Infrastructure Safety such as elevator safety products

- Medical such as devices for assessing eye health

- Process Safety such as flammable gas detectors

- Environmental & Analysis such as opto-electronic sensors and technology

Based on the firm’s 2021 annual report, the Process Safety segment accounted for the least portion of the overall revenue. Compared to the 14% it contributed to the recorded revenue, Infrastructure Safety, Medical, and Environmental & Analysis accounted for 34%, 28%, and 24% of the entire figure.

Halma’s Profitability

Similar to other stocks, the firm’s profitability is a crucial aspect in forecasting Halma share price movements for the short and long-term.

| 2017 | 2018 | 2019 | 2020 | 2021 | Trailing twelve months (TTM) | |

| Gross profit | 640.4 | 799.9 | 783.7 | 832.5 | 904.2 | 1,043.9 |

| Operating income | 211.0 | 262.7 | 285.2 | 298.5 | 339.2 | 374.5 |

| Net income | 162.5 | 216.4 | 221.1 | 229.3 | 280.4 | 352.9 |

| Dividend per share | $0.17 | $0.21 | $0.20 | $0.21 | $0.24 | $0.24 |

A look at the table above shows that Halma is a profitable firm. However, as it continues to record a surge in revenues, it may experience some challenges in translating the observed growth into earnings. At the same time, Halma uses mergers and acquisitions as part of its growth strategy. It has acquired 53 firms; 8 over the past 5 years. Even with these M&As, its balance sheet remains healthy; an aspect that further substantiates the bullish outlook for its stock in the medium to long term.

Halma share price forecast

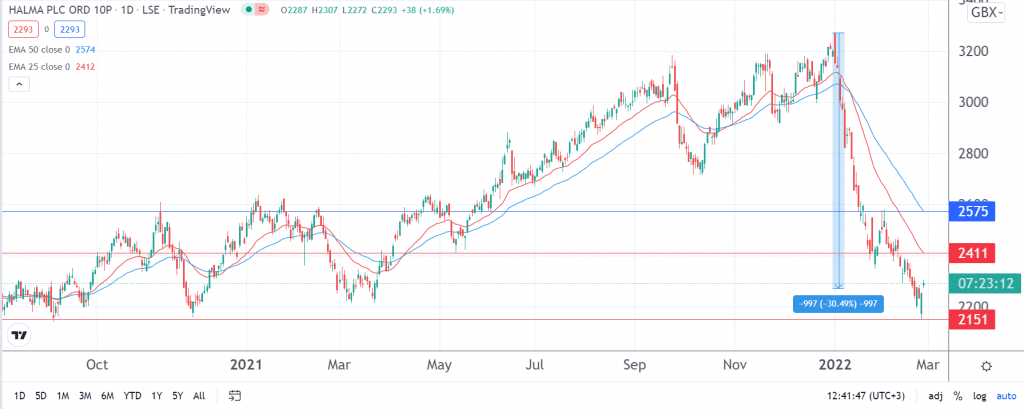

Halma share price has been in the red for 8 consecutive weeks. Since hitting its all-time high of 3,272 GPX at the beginning of 2022, it has dropped by over 30%. On Thursday, it dropped to 2,151; its lowest level since September 2020. Granted, it has since bounced off to 2,285 as at 09.04 a.m UTC.

On a daily chart, it is trading below the 25 and 50-day exponential moving averages. A look at both the fundamentals and technicals presents a buying opportunity for long-term investors. In the short term, I expect Halma share price to remain below the 25-day EMA at 2,411 as the equities market remains under pressure.

In the coming weeks, the bulls may gather enough momentum to break the aforementioned resistance and rally further to 2,575, along with the 50-day EMA. However, a move below the recently-hit 18-month low will invalidate this bullish outlook.