- The gold price is retreating for third day as the U.S. dollar continues its recent bounce, but the precious metal is at risk of a larger correction.

The gold price is retreating for a third day as the U.S. dollar continues its recent bounce, but the precious metal is at risk of a larger correction.

Gold had rallied last week following comments from Federal Reserve Chairman Jay Powell, in which he reiterated the bank’s commitment to the 2% inflation target. His comments also confirmed to traders that deflation would be fought with the same policies as they have been in previous years and the threat of inflation, against the backdrop of a growing Fed balance sheet, has been the driver of a weaker dollar and stronger commodities in the last few weeks.

This week has seen the gold run reverse after strong manufacturing date from the U.S., in the form of the ISM Manufacturing index, boosted hopes that the U.S. economy could recover more quickly than expected.

The dollar has shrugged off weaker data yesterday after the ADP employment number missed expectations by 50% Analysts expected 1 million new jobs, but the actual figure was nearer 500k. This miss could be confirmed by U.S. jobless claims this afternoon, followed by the Non Farm Payrolls number tomorrow.

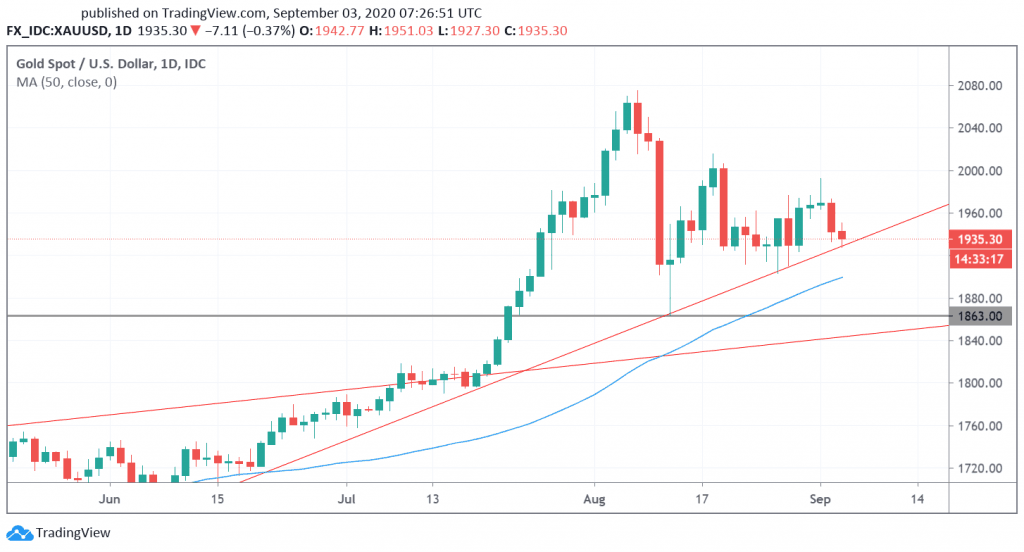

Gold Price Technical Outlook

Gold had retested the $2,000 level as I suggested it would last week. The failure to breach that level is leading to a potential third-day lower. The price is testing the uptrend line support at $1930 and if it doesn’t hold then a larger drop is possible to $1863, or $1840. Getting back above $1960 would signal that the upside is back in play.

Gold Price Daily Chart