- Gold price is under selling pressure for one more day and is approaching the critical $1,412 support. Stronger U.S. dollar helped by improved

Gold price is under selling pressure for one more day and is approaching the critical $1,412 support. Stronger U.S. dollar helped by improved sentiment around US – China trade negotiations contributed to further pressure on Gold.

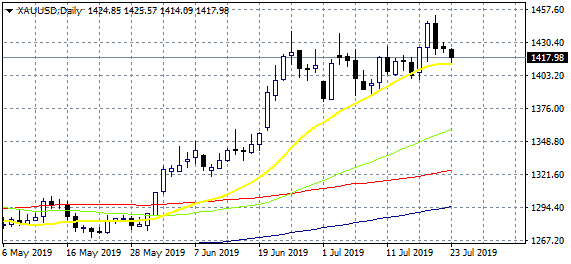

The low for the day is at $1,414.09 and the high at $1,425.57. The main trend is still bullish but the short term momentum shifted to the downside. In the mid-term, gold prices are trading sideways between $1381, and the year-to-date high at $1439.

Immediate support for the yellow metal stands at $1,412 the 20 day moving average, then at $1,400 and $1,386 the low from July 5th a figure that traders who missed the recent rally waiting to enter long positions. On the upside resistance would be met at 1,425 the today’s high and then at 1,428 the 50 hour moving average before an attempt to 1,439 the high from June 26th.

Bulls are controlling the game as long as the price holds above 1,400. A break below will question the positive momentum, but I will wait for a break below 1,390 to start any short positions. The symmetrical triangle that had sketched is a continuation pattern meaning that gold is taking a short breath before it will continue higher. If the triangle support at 1,390 failed to stop the price then I will open a short position. A buy signal for me will occur If gold moves above 1,425 mark.

Traders must be cautious on gold at current level as the volatility is very high.Don’t miss a beat! Follow us on Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.