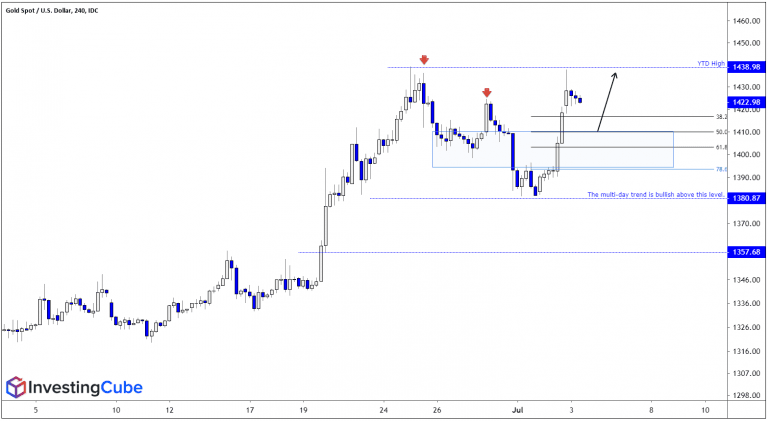

Yesterday, around the close of the European session, gold prices leaped higher and did not stop until prices reached $1437.88 at 2 am London time. The price has since then pulled back and reached a low of $1422 at the start of today’s European session. Trading has been muted this London morning, as traders digest the overnight gains, and also as the risk-reward ratio for fresh new positions is low at the current levels of $1425.8. I suspect traders will wait for a corrective decline before adding to their bullish exposure. The prime level I am watching is the 50% correction level of the gain from this week’s low to this week’s high at $1409.94; the secondary support level can be found at $1400, followed by $1387.87. The short-term trend will remain upwards as long as the price trades above this week’s low of $1380.87, and a break to this level might send the price towards the June 19 low at $1357.68.

As for long terms targets, I still assume that the price might reach the $1600 level following the breakout from the 2013 to 2019 price range consolidation, as the Federal Reserve is anticipated to reduce rate in 2019. For more on my long-term view read: Gold Prices Might Form Next Bull Leg From $1405.Don’t miss a beat! Follow us on Twitter.