- Gold price keeps a bearish bias as long as it fails to hold above $1,900 and while it remains below dynamic resistance. US elections uncertainty mounts.

Gold price hovers more or less around the same levels for over a month now. Both bulls and bears fight for the key $1,900 level, and it appears that the market needs something extra for a decisive move in either direction.

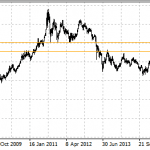

After it broke above the $2,000 level during summer trading, the gold price was unable to hold it. Moreover, in the last month, it had a hard time holding the $1,900 too. Furthermore, it formed a reversal pattern (contracting triangle) and also met dynamic resistance.

Can the price of gold move lower? If so, what would be the trigger?

Higher USD As a Result of US Elections Uncertainty

US elections uncertainty could affect the price of gold in the short to medium term. After most of the states were called, neither of the two candidates can claim victory. Also, it appears that the market will get less stimulus than it hoped for, should the Congress projections turn out valid.

As such, we may see a jump in the US dollar as a result of rising uncertainty. If that is the case, the price of gold could easily slip below the apex of the running triangle formed at the start of the year.

Gold Bearish Technical Outlook

The gold price’s technical outlook looks bearish. As long as the price of gold cannot close and hold above the dynamic resistance given by the rising trendline, bulls will have a problem.

While below that trendline and below the $1,900 level, bears have a case and a proper risk-reward ratio to use. More exactly, bears may want to go short at market or from higher levels (as long as the price of gold does not close above dynamic resistance). The invalidation of this bearish scenario is at $1,950 (the apex of the non-limiting triangle that acted as a reversal pattern. As for the take profit, bears may either use a risk-reward ratio of 1:2 or 1:3 or just stay on the short side for the reversal triangle’s measured move.