Gold price is under intense pressure today even after relatively strong inflation numbers yesterday. The XAU/USD price is trading at 1,842, which is substantially lower than yesterday’s high of $1,958. Other commodities are also struggling, with the silver price falling by more than 1.2% and lead and zinc falling by about 1%.

What’s happening: Gold investors love it because of its role as a hedge against inflation. Yet gold prices soared in 2020 after the inflation in the United States declined. Yesterday, data from the government showed that the consumer price index in the United States rose to 1.4% in December.

The core consumer price soared to 1.6%. This means that the CPI could jump to more than 2% in the next few months. In theory, this should be a good thing for gold prices. However, in reality, it also means that the Fed will possibly increase interest rates faster than earlier expected. In fact, several Fed speakers have welcomed the idea of higher rates, which tend to harm gold.

Gold price is also falling because of the resurgent Bitcoin. Bitcoin price has jumped by more than $4,000 in the past 24 hours. This has likely pushed more people from gold to BTC.

Gold price prediction

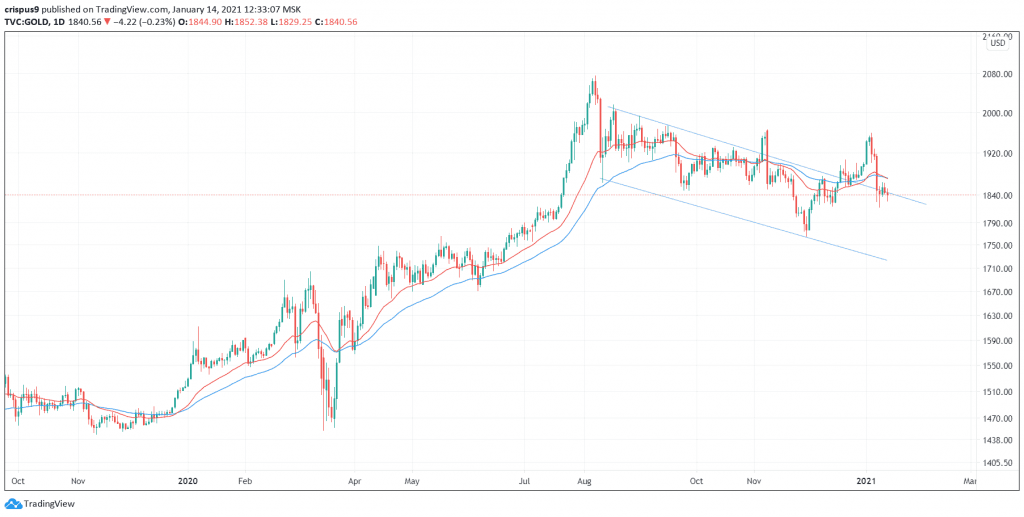

On the daily chart, we see that gold price has moved back to the descending channel that was formed a few weeks ago. The 25-day and 15-day exponential moving averages have also made a bearish crossover pattern.

Therefore, in my view, I suspect that the price will move lower past the current flag pattern. If it does this, the next level to watch will be the lower side of the channel at $1,765.

Don’t miss a beat! Follow us on Telegram and Twitter.

Gold technical chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Crispus on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.