- Gold price has gone nowhere this week as investors wait for the upcoming American consumer inflation data.

Gold price has gone nowhere this week as investors wait for the upcoming American consumer inflation data. It is trading at $1,845, which is slightly above this month’s low of $1,845. It is trading about 11% below the highest point this year, meaning that it is still in a correction zone.

US inflation data

The XAU/USD price has been in a consolidation phase since the US published the latest jobs numbers last week. The data revealed that the US labour market was doing well as the unemployment rate remained at 3.6%. In economics, an unemployment rate below 5% is usually seen as full employment. The economy still has millions of vacancies while wage growth is still steady.

The next key catalyst for gold price will be the upcoming American consumer inflation data that will come out on Friday. Analysts expect the data to show that inflation remained close to its highest level in over 40 years.

Precisely, the headline CPI is expected to have risen to 8.3% while core CPI declined slightly. These inflation numbers will come on a day that the average gas price is expected to have risen to $5 per gallon.

Still, these numbers will likely not have an impact on the Federal Reserve, which is committed to continuing tightening in the coming months. Its FOMC committee will meet next week and possibly deliver another 0.50% rate hike. Analysts believe that the bank will continue with its quantitative tightening process.

Gold price forecast

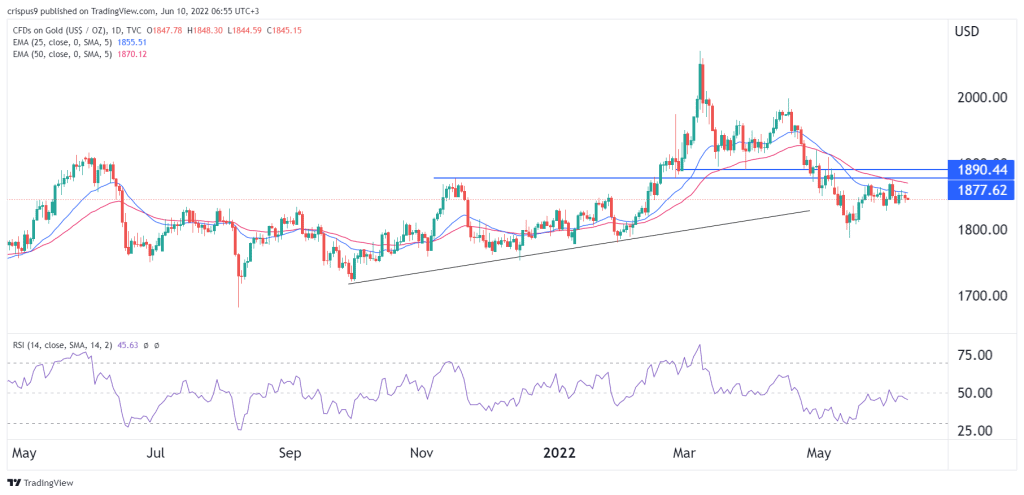

The daily chart shows that the XAU/USD pair has been in a consolidation phase in the past few days. The price is significantly below the year-to-date high $2,072. The price has struggled to move below the important resistance levels at 1,877 and 1,890. Notably, it remains below the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has moved below the neutral level at 50.

Therefore, gold price will likely remain in a bear market as long as it is below the two moving averages. The next key support level to watch will be at $1,800. A move above the resistance at $1,890 will invalidate the bearish view.