- The Glencore share price has made a spectacular recovery in the past few days. GLEN shares are trading at 513p

The Glencore share price has made a spectacular recovery in the past few days. GLEN shares are trading at 513p, which is about 18% above the lowest level on May 12th. The stock has already jumped by almost 400% from its lowest level on March 2020. This makes it one of the best performing mining companies in the FTSE 100.

Glencore is doing well

Glencore is one of the leading mining and trading companies globally. It has a market cap of more than 69 billion pounds. Its history can be traced back in 1970s when a young trader known as Marc Rich started trading commodities in countries like Russia and Congo. Its growth accelerated when it merged with Xstrata in 2013.

Today, Glencore is a well-known and controversial company. It deals with products like copper, cobalt, coal, nickel, gold, silver, and oil among others. One reason why the company has been controversial is its decision to stick with coal even as other companies sell their coal businesses. This decision has proved successful since demand for coal has jumped at a time when investments in the industry are falling.

Unknown to many, Glencore is one of the biggest players in the oil industry. In it, the firm acts as a trader who connects buyers and sellers. As a trader, the firm handles more than 4 million barrels per day. Additionally, the company deals with important metals like nickel and cobalt that are useful in the manufacture of batteries.

Glencore’s business is doing well. Its annual revenue rose from $148 billion in 2020 to over $203 billion in 2021. Its profit also surged to over $4 billion. And with the current state of affairs, analysts expect that the company’s business will do well this year.

Glencore share price forecast

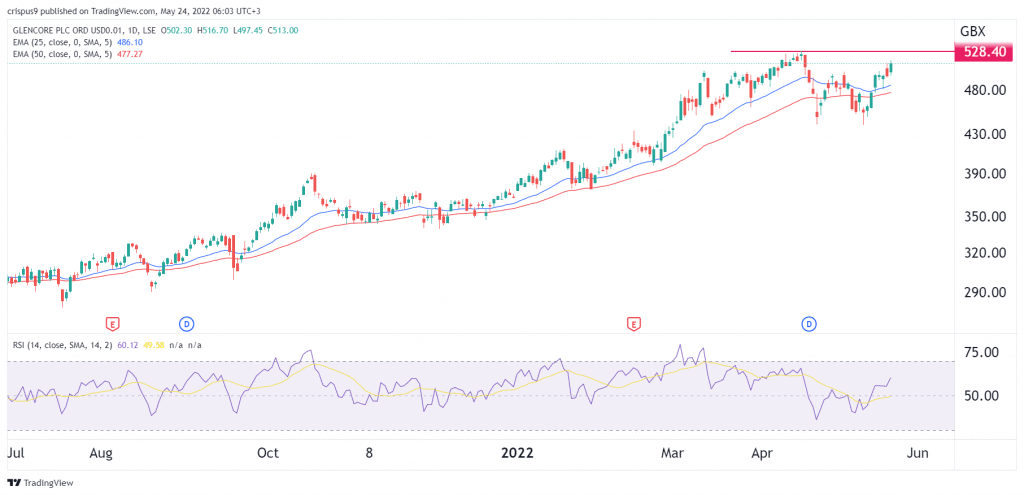

On the 1D chart, we see that the GLEN share price has been in a strong bullish trend in the past few months. The stock is now trading at 513p, which is close to the year-to-date high of 530p. It is also being supported by the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has moved above the neutral point at 50.

Therefore, by moving above the resistance at 500p, it is a sign that bulls are taking over. As such, there is a likelihood that the stock will keep rising. This bullish outlook will be confirmed if the stock moves above the resistance at the YTD high of 528p. A drop below the support at 480p will stop this view.