The British Pound continued to recover on Friday vs. the American Dollar (GBPUSD) and could remain strong as the price trend remains upwards. Optimism around a Brexit deal has soared in the last few days, sending the British Pound higher, despite it only being 67 days until the UK will leave the European Union. UK PM Boris Johnson can’t give a definite answer if there will be a new deal for the UK, but he thinks that there is now a “reasonable chance” that the UK will leave with some sort of deal. One of his tactics has been to remind the EU that the UK might not pay the full £39bn EU divorce bill in case of a no-deal Brexit.

However, there is very little information around the actual talks, and investors only have high-level comments from the likes of Boris Johnson to trade on, the situation could therefore quickly turn bad for the GBP, and volatility should remain high until the markets have more clarity.

Don’t miss a beat! Follow us on Telegram and Twitter.

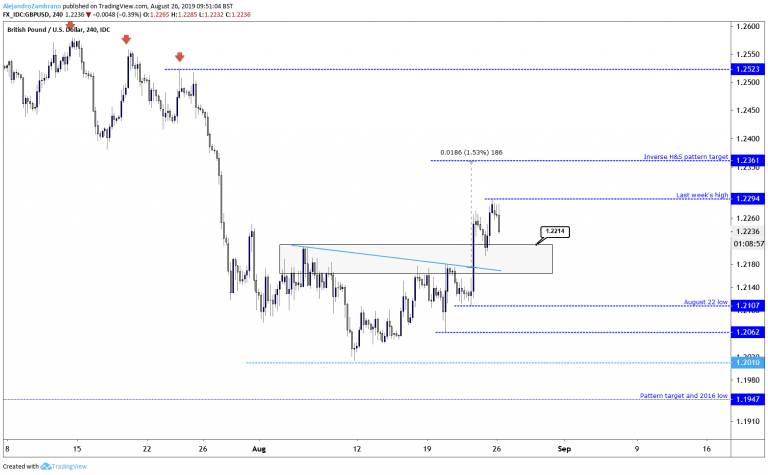

Technically, the GBPUSD trend remains upwards, and last week in our daily market brief I said that a break to 1.2210 could send the price higher. The price reached as high as 1.2293 and is still short from reaching the inverse head and shoulders pattern at 1.2361. The inverse head and shoulders pattern is derived by treating the August 12 low as the head, and the August 1 and 20 lows as the right and left shoulders respectively. The short-term trend will remain upwards as long as the price trades above the August 22 low of 1.2107, and I suspect that if the price might find support in the 1.2107 to 1.2214 interval, before revisiting last week’s high of 1.2294. However, if the price was to trade below the August 22 low then this would indicate that the GBPUSD might have resumed its multi-week downtrend.Download our latest quarterly market outlook for our longer-term trade ideas.

Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.